President Trump is now doing to Communist China what Reagan did to the Bolshevik Communists behind the Soviet Union: defeating them economically.

President Trump is now rewarding the countries who came to the table to negotiate a new tariff deal - with a 90 day pause - while doubling down on Communist China - who retaliated. This is called carrot & stick. This is how you break Communist China, ECONOMICALLY, the same way Reagan broke the Soviet Union.

THANK YOU FOR YOUR ATTENTION TO THIS MATTER!

Scott Bessent, President Trump’s Treasury Secretary, has been making the rounds giving interviews. So far, I’ve seen him on Tucker, All-in, NBC, CBS, CNN, CNBC, Kudlow, Axios and more. You name it, he’s talking to them and explaining Trump’s economic plan to revive America.

Few people know that Scott Bessent used to work for George Soros - and he knows all the enemy’s tricks. Scott Bessent and George Soros sought to profit from the British pound's devaluation by betting against it in 1992. They believed that the British economy and the pound's value were unsustainable within the European Exchange Rate Mechanism (ERM), which fixed exchange rates to the German mark. The Bank of England's efforts to maintain the pound's value by hiking interest rates into the teens were seen as artificial and unsustainable.

The UK's high inflation rate, which was three times that of Germany, and higher interest rates were factors that Soros and others thought would lead to the pound's depreciation. By shorting the pound, they aimed to profit from its expected decline in value.

Soros and Bessent, along with other speculators, saw that Britain's position in the ERM was unsustainable and that the pound would eventually have to be devalued or the UK would have to leave the system altogether.

This trade not only resulted in significant profits for Soros and Bessent but also highlighted the growing power of financial markets over government monetary policies. Soros and Bessent's strategy involved accumulating a large short position on the pound, anticipating that it would devalue. When the Bank of England's interventions failed to stabilize the currency, the pound's value plummeted, leading to Black Wednesday on September 16, 1992.

Soros also was involved in the creation of NGOs to use as fronts for CIA activity around the world. During Reagan's presidency, the administration adopted a strategy that involved using non-governmental organizations (NGOs) as instruments of statecraft. One of the key organizations in this strategy was the National Endowment for Democracy (NED), which was explicitly created by the CIA director to disguise the CIA's involvement in funding its assets.

Soros recognized the strategic opportunities presented by the Reagan administration's approach and exploited his relationships with the NED and other influential bodies. The NED was operational by the early 1980s and was used to orchestrate CIA-backed color revolutions in Central and Eastern Europe.

Soros's involvement with the NED and other organizations like the Open Society Foundations, the U.S. State Department, the U.K. Foreign Office, and NATO has been the subject of various theories and investigations. Some sources suggest that Soros had insider knowledge of impending government overthrows orchestrated by the CIA, which he used to predict currency movements and make substantial profits.

George Soros, while not directly tied to the CIA and USAID, has had a significant presence in discussions about U.S. foreign policy and intelligence activities, starting with the Reagan administration.

In 1984, Soros started to change his views as to his purpose. Soros published an article criticizing the Reagan administration's economic policies, which he argued had developed a form of economic imperialism. He stated that the high budget deficit was being financed at the expense of debtor nations, leading to a benign cycle for the U.S. but a vicious cycle for these countries.

Soros pointed out that the budget deficit was an unintended consequence of the Reagan administration's desire to cut public spending while maintaining a strong military posture and reducing taxation. This led to higher interest rates, which were detrimental to debtor nations. He warned that the policy was likely to appeal to U.S. voters but would have disastrous consequences for other countries.

Soros argued that the Reagan administration's anti-Communist stance and interference in the internal politics of countries within the U.S. orbit were creating oppressive regimes. He suggested that if the U.S. did a better job in ensuring the freedom and prosperity of these countries, there would be less need to rely on military might.

Through the years, Soros has been a significant Democrat political donor and so-called philanthropist. Soros has also had ties to USAID, the U.S. Agency for International Development. His organizations have partnered (laundered money for the CIA) with USAID on various projects, including support for the Orange Revolution in Ukraine.

During the Reagan administration, the CIA was heavily involved in anti-Soviet activities, including covert operations and funding of resistance movements. That didn’t stop once the wall fell.

So, why do I think President Trump hired Bessent, who was once a foot soldier for Soros? I think that the New World Order has finally realized that their misguided strategy (using Soros and NGOs) to try to instill “democracy” around the world in places like Communist China, to prevent war and gain control, is not working.

Communist China, and their totalitarian allies around the world, did NOT suddenly embrace “democracy” to become kinder, gentler nations. Instead, they became stronger and MORE tyrannical - they stole our money, our intellectual property, our industry and used our “kindness” and our money against us to build even bigger armies, sell us more stuff, create more pollution, and build more nuclear weapons. They pretend to be a “developing” nation while milking us dry.

Now, Trump, I believe, has hired Bessent to do to Communist China what he did to the Bank of England. Break it. And, finally, every honest person on both sides of the aisle gets it and is on board. Those who aren’t on board are frankly only in it to make money for themselves OR are paid to resist Trump & Bessent.

Make a note of who those people are - the ones who are openly speaking out against tariffs and Trump’s economic reset - as you encounter them. Those people are the real resistance.

Here are some key statements from all the interviews that Bessent has given lately on tariffs and the Trump economic plan - in no particular order. These are HIS words - and I’m not spinning them like the fake news does.

BESSENT: “The President's been talking about this for four decades, and this is transformational for the American economy, for the America worker, and for the new Republican alignment.

The original tariff man That was Alexander Hamilton, and he used tariffs to fund the new nation and to protect American industry. President Trump has added a third leg to the stool and he uses tariffs to negotiate.

I was a freshman in college when Ronald Reagan came in in 1980. For years, the American worker Middle class has been eviscerated, American workers have taken it on the chin. President Trump sensed it 40 years ago. He has promised the American workers that the old standard of living can come back.

A lot of our trading partners, including some of our allies, have not been good partners. If tariffs are so bad, why do they have them? Or if the American consumer is gonna pay all the tariff, then why do they care about tariff? Right, because they're gonna eat them. This is the beginning of a process. We're going to re-industrialize that we have gone to a highly financialized economy. We have stopped making things, especially a lot of things are relevant for national security.

I think one of the few good outcomes from COVID was we had a beta test for what maybe a kinetic war with a large adversary could look like. And it turned out that these highly efficient supply chains were not strategically secure. We don't make our own medicines, we don’t make our own semiconductors, we don’t make our own ships anymore. So economic security is national security. President Trump and I have talked about that a lot.

The stock market goes up and down. Warren Buffett has a saying, in the short run, the market's a voting machine. In the long run, it's a weighing machine. And in the long-run, it is going to weigh, do we have good policies?

For everyone who thinks that these market declines are all based on the president's economic policies, I can tell you that this market decline started with the Chinese AI announcement of DeepSeek.

So the so-called Mag-7, the tech stocks, had been doing very well for about 18 months, led the market. And I think that there was kind of a real dose of reality in what was going on in AI. I think U.S. is gonna remain the leader in AI, but the AI related stocks started coming down. I'd say it's more a MAG 7 problem and not a MAGA problem.

President Trump wants to put in sound fundamentals for the underlying economy. And if the underlying economies good, if taxes are stable, if businesses have predictability, If we have cheap and plentiful energy, if we deregulate, if they treat our workforce well, then we're going to have a great stock market.

The Chinese have a very different economic system. They have low cost, some would call it literally slave labor. They subsidize industry with subsidized loans. They have a lot of non-tariff barriers.

There's a study out recently from a group at MIT that shows that with President Trump's first China tariffs, which were approximately 20%, the price level went up 0.7. So to answer your question If we could put on a 20% tariff and have the foreigners pay that and use that money to bring down our government deficit and keep taxes low here, that's a very unique formula that hasn't been tried in this country for a long time.

CBO scoring is a lot like Enron accounting, that it's not real.

I think tariffs could bring in anywhere from $300 billion to $600 billion a year. The ultimate goal of the tariffs: bring your factory here. Move your factory from China, from Mexico, from Vietnam, bring it here.

I think with AI, with automation, with so many new smart factors, that we’ve got all the labor force we need right here in America.

One of the reasons I came out to work for Trump was I was worried about an impending financial calamity given the high levels of government spending that were leading to high levels of government debt. This is an opportunity to right-size the federal government and unleash the private sector again, because it's been hemmed down by excessive regulation, and it's been crowded out by the government.

The old system wasn’t working. It could have been really fun for me to come in and just keep issuing a lot of debt. It's almost like a bodybuilder taking steroids. The outside looks great, you're muscular, but inside you're killing your vital organs. That's what was going on here. But it would have been easy to keep pumping up the economy, borrowing a lot of money, creating a lot of government jobs. But we were going to end up in a calamity.

If you go back and look, you look at the financial crisis in 07, 08, economy looked great right up until then. You go back and you look at the end of the dot-com bubble, and then the whole credit problem, the fraud at WorldCom, Enron, some other companies. Economy looked great until it didn't. And I think one of the things that we won't get credit for, but that this administration will have done is avoiding a financial calamity.

We're pushing to get the tax bill done so we can guarantee the low taxes, full depreciation within the first year. We're working with Secretaries Burgum and Wright on energy security, and we're working on getting the regulations down.

I used to teach economic history, when you look at the history, we are the debtor nation. We have the trade deficits. The surplus nation is in the weaker position, because the Chinese business model and the Chinese economy are the most unbalanced, imbalanced in the history the modern world. We've never seen anything like this in terms of their export level relative to their GDP, relative to the population. So I think it is going to be very difficult for them to try to change the model. They're in a deflationary recession slash depression right now. They're trying to export their way out of it, and we can't let them do that.

I think President Trump will break their business model with these tariffs. They've just got such a big deficit with us that they need our markets. They can't survive without them.

I'm not happy with what's going on in the market today, but the top 10% of Americans own 88% of equities, 88% of the stock market. The next 40% owns 12% of the stop market. The bottom 50% has debt. They have credit card bills. They rent their homes. They have auto loans. And we've got to give them some relief.

Americans don't want handouts. The Democrats had this strategy called compensate the loser. So first of all, the name of that strategy, I don't think the bottom 50% of Americans are losers. I think the system hasn't worked for them. I think that they are winners. It's just a bad system. So we are going to fix the system. And look, they want good jobs. They want their kids to do better than they did. They wanna own a home. They wanna pay down their debt. That this isn't hard and I think that we can do this in the next four years.

My family was very affluent, early settlers, we were very affluent for about 250 years. My dad made a lot of bad financial choices, so when I was born, first 6, 7, 8 years, we were affluent. He lost everything, and so I've seen what that's like. I've see both sides that I was fortunate enough to be able to make it back, and I know what economic insecurity is like.

I was out on a campaign trail with President Trump and there are the union workers, the steel workers, they got on their hats, they got in their vests, they're with their children. And it's very moving. Like they just want a better life. They want their communities to be sound. They want the kids to do better. They want a little league baseball. like They don't care what's going on in Madison Avenue. They don' know what the hot new restaurant is in Paris.

During the month of January, 10-year interest rates, which is probably the most important rate in the country, mortgages are based on that, business and capital formation is based on, that I came in and that it almost spiked to 5%. And I think 5% can be an uncomfortable area for the economy, for Treasury who has to issue a lot of bonds. During my confirmation hearing and I was actually at a dinner that Jerome Powell was at last night, at my confirmation hearing, I said, you know, I'm only going to talk about the mistakes the Federal Reserve has made in the past. They got into DEI, they get into climate. I actually think that that impinges on their monetary policy and makes them vulnerable. So I think that they should focus on monetary policy, doing the best that they can for the American economy, the American people, keeping inflation low. And then the rest, there are a lot of other banking agencies too. So the Fed controls the weather now too? What were they doing?

They failed. The regulators failed. And I think that's what people are getting sick of. Why is gold moving around the world in such huge quantities right now? Well, a couple of things. Physically, it's moving because of potential tariffs here. It was unclear whether we were going to exempt gold from tariffs, which I believe we have. So there was a big move out of vaults in Switzerland, out of a vaults and London to get it into. And look at that. There are a lot of different stores of value over time. Bitcoin's becoming a store of value. Gold has historically been a store a value. I think what's interesting is where do we see the gold demand coming from? A huge amount is from the Chinese people. Yes, they're in the middle of an economic recession slash depression. And people don't trust the Chinese currency. because they have capital controls. There are 1.4 billion Chinese who want to get their money out and they won't let them. They will let them buy gold.

No one should listen to anyone in the markets talk about the US dollar other than President Trump or myself. We are the only ones who speak for this administration, the United States government on dollar policy. I can tell you, we have a strong dollar policy and we're putting in all of the necessary ingredients to make sure the dollar is strong over the long run.

I was very fortunate and went to Yale and I got an internship from an individual who taught me the investment business really well. His name is Jim Rogers - he’s famous because he was George Soros’s first partner. At Soros, I worked for a fellow who is my mentor Stan Druckenmiller.

The first time I met President Trump he said: "Scott how are we going to get these debt and deficits down without causing a recession?"

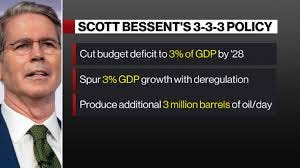

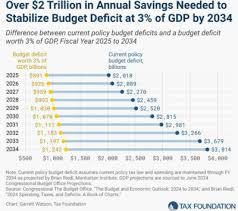

I said: "Sir, we're going to set goals. By 2028, we want to get back to the long-term average of a 3% budget deficit to GDP. We don't have a revenue problem, we have a spending problem. We going to spur growth to 3% with deregulation. We’re going to increase the energy supply by 3 million barrels of oil per day.”

The Biden administration blew out the spending. We now have to pay $1.2 trillion in interest payments per year.

One of the reasons that President Trump was elected was the affordability crisis. So we are in the process of deregulating, which will free the supply side, and we are cutting back the government spending. Since President Trump has been in office, interest rates on the 10 year bond, which I am focused on, have been down every week. Mortgage rates have been down every week.

China is going to pay for the China tariffs, because their business model is exporting their way out of this inflation. They are going to continue flooding the market. They will eat any tariffs that go on.”

Here are two longer interviews to watch if you want more information on Bessent:

This is a nice recap:

TANYA RATNA: Let’s be honest: When most people hear "tariffs," they think price hikes and trade wars. But the Trump administration’s latest tariff rollout is not merely a knee-jerk protectionist move—it is part of a far broader strategy.

What is actually in play here is a high-stakes effort to build up leverage and resources to manage America’s debt, reset its industrial base, and renegotiate its standing in the global order.

And it all begins with a problem most people have not been told enough about. In 2025, the U.S. government must refinance $9.2 trillion in maturing debt. Some $6.5 trillion of that comes due by June.

According to Treasury Secretary Scott Bessent, each basis-point (one one-hundredth of a percent) drop in interest rates saves the government roughly $1 billion per year.

So, keeping yields low is not just sound policy—it is a fiscal necessity. However, even cheaper debt does not solve everything. The deficit remains massive—and that is where spending cuts come in.

Elon Musk's DOGE has promised $1 trillion in cuts to the deficit by targeting $4 billion in daily spending cuts.

At this point, we have two pillars: lower borrowing costs and tighter spending. But there remains a third—and arguably most important—pillar: growth.

Tariffs serve as the ignition switch for growth. The objective is not to punish trade partners—it is to make domestic industry viable again to rebuild critical capacity.

The goal is to deliver visible job growth and factory activity before the November 2026 midterm elections. In the meantime, tariffs themselves will generate revenue—an estimated $700 billion or more in the first year. That creates more fiscal room for the administration to enable tax cuts without touching any critical programs.

These tariffs do not exist in a vacuum. They are being deployed alongside a deliberate reshaping of global alliances. The U.S. is quietly distancing itself from NATO, recalibrating ties with Europe, and opening previously frozen diplomatic channels with the Gulf nations and Russia.

Why? Because the post-Cold War trade order no longer serves U.S. interests. It enabled deficits, offshoring, and strategic dependency. Now, tariffs become leverage. Allies who align with U.S. priorities receive relief; others face higher costs or worse.

Communist China relies on $500 BILLION in exports to America to survive. President Trump is making deals with Japan, South Korea, Vietnam and India for another $500 BILLION to surround and circumvent China. That's the ball game.

Communist China, naturally, is the central target. They have grown way too big for their britches. For years, economists have argued that China’s artificially weak currency and industrial overcapacity have distorted global trade. Tariffs are one way to force a reckoning with the CCP - and potentially, a revaluation of the yuan.

By setting his tariff announcement to April 2, Trump ensured that US traders would have two full days of trading before the Chinese could fully respond due to the Chinese holiday. The Chinese market traded in the aftermath of Trump's tariff announcement, closed at 3 AM EST Thursday and wouldn't reopen until Monday.

President Trump said he will impose an additional 104 percent tariff on goods imported to the US from China on April 9 at 12:01 am.

China sends ~$500B to the US (15% of its exports), while the US sends just ~$150B to China (7%). With domestic demand already fading, losing its top export market will hammer the Yuan and trigger a global flight to US Treasuries, driving down rates for the US just as we need to refinance $9 TRILLION in maturing debt. Bessent is literally orchestrating a collapse of the Yuan similar to what he did to the pound in 1992.

The sectors most likely to benefit—steel, automobiles, textiles—are concentrated in battleground states. Team Trump is betting that visible wins in those regions will outweigh short-term pain in sectors dependent on cheap imports.

GLENN BECK: “It’s the Great Reset. We were heading towards globalism and eating bugs and Trump said NO.”

This is one of the most ambitious fiscal and industrial resets in 50 years. I believe that history will call this the real GREAT RESET.

My work is free and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

If you like my work, you can fund me by becoming a paid subscriber on Substack, donate by credit card here or you can send me a check to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801- or just send me a note or a card! I love hearing from you! You can also reach me by email at Peggy@TierneyRealNewsNetwork.com.

If you received this newsletter by email, you can always find the most recent version at my website along with a link to share.