I haven’t seen anyone report on President Trump’s plan for a “Sovereign Wealth Fund” in America other than to brush it aside or attack it as meaningless hyperbole. After some study, I think the naysayers are very, very wrong. I think this is a HUGE deal for America and We the People.

I think the Sovereign Wealth Fund (SWF) goal is an integral part of Trump’s plan to use America’s assets and untapped resources to MAKE AMERICA WEALTHY AGAIN. I also think that’s why he chose to meet with certain countries FIRST to discuss tariffs, trade and investment.

Here’s how I think the SWF will impact, and benefit, everyday Americans like you and me and why we all need to understand how it will work. The details aren’t out yet - but here’s what you need to know for now…

In February 2025, President Trump launched America’s first-ever Sovereign Wealth Fund.

The Executive Order directed Bessent & Lutnick to deliver a plan within 90 days for the creation of an SWF. It said:

“The creation of a SWF for the United States will help maximize the stewardship of our national wealth. Sovereign wealth funds exist around the world as mechanisms to amplify the financial return to a nation’s assets and leverage those returns for strategic benefit and goals. The United States can leverage such returns to promote fiscal sustainability, lessen the burden of taxes on American families and small businesses, establish long-term economic security, and promote U.S. economic and strategic leadership internationally.

The United States already holds a vast sum of highly valued assets that can be invested through a sovereign wealth fund for greater long-term wealth generation. The Federal government directly holds $5.7 trillion in assets. Indirectly, including through natural resource reserves, the Federal government holds a far larger sum of asset value.”

Within minutes, his plan was attacked by gold grifters, Koch lackeys and left-wing economists:

Bloomberg said, “Don’t let President Trump near it.”

Billionaire Mark Cuban called it, “Stupid.”

And gold grifter Peter Schiff said, “It’s preposterous.”

But, Jim Rickards, one of the few economists that I trust, said: “Trump’s SWF will be the wealth-generating event of the century. Bigger than A.I., crypto and the last real estate boom – combined. I won’t be surprised if it lands Trump a place on Mt. Rushmore…”

“Or immortalized on the new $1,000 bill.”

Those are pretty big words coming from Rickards, a former adviser to the White House & the Federal Reserve. Let’s look at his reasoning…

Rickards says that America is sitting on a “national inheritance” of untapped mineral assets worth an estimated $150 trillion. That’s enough to pay off the national debt, four times over.

U.S. Treasury Secretary Scott Bessent recently said: “We’re going to monetize the asset side of the U.S. balance sheet.” What does that mean, exactly? I wrote about that a few months ago.

The important thing to know is: America is much wealthier than most people think. Yes, we are $36 trillion in debt. But America is also sitting on a $150 trillion in untapped assets.

It all ties back to Trump’s Executive Order #14196 – which lays the groundwork for America’s first-ever Sovereign Wealth Fund. A Sovereign Wealth Fund (SWF) is a pool of wealth set aside by a country, for the benefit of its people.

The biggest Sovereign Wealth fund in the world is in Norway. Thanks to its rich offshore oil fields, it was able to set aside more than $2.8 trillion - which translates to roughly $350,000 per citizen. China also has a $1.8 trillion wealth fund called the China Investment Corporation. Then there’s Saudi Arabia. Its sovereign wealth fund is paid for by its endless oilfields. Today, it’s worth roughly $1 trillion.

To be fair, Trump’s SWF will not be doled out to all citizens. It’s not going to fund a big round of COVID-style checks or anything like that. He’ll tap into a stockpile of wealth that was set aside many years ago, an incredibly valuable asset which has grown over the decades. If he succeeds – which I believe he will – it could put every other Sovereign Wealth fund in the world to shame.

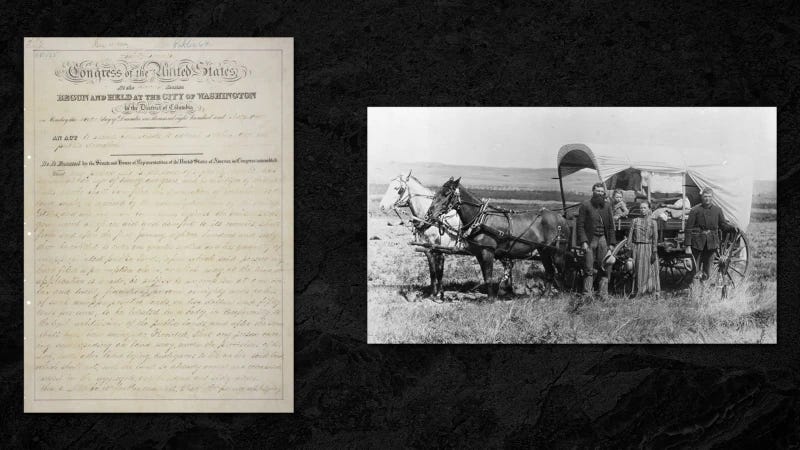

RICKARDS: It all started years ago when the 42nd Congress changed Title 30 of the U.S. Code (MINERAL LANDS AND MINING) and established a “secret trust” for the American people.

The nature of these mineral assets is such that politicians haven’t been able to raid them… which has allowed their value to grow untouched, for decades.

This is not some kind of government program like Social Security or Medicare. It’s not earmarked for any specific person or group. But it will offer the average American a chance to become richer than they ever imagined. I’m not talking about a hoard of cash or bonds or anything like that.

It will be like a new “homestead act” for America.

Back in 1862, America was a young nation. And it needed people to populate the western states. That’s when President Lincoln signed the “Homestead Act.”

I don’t pretend to understand how the Homestead Act intertwined with the US code but I trust Rickards when he says it does.

The “Homestead Act” instantly granted any American citizen the right to claim 160 acres of public land for $18. Their $18 investment equates to around $562 today, while 160 acres of farmland is worth about $900,000. To get all this “free land,” they had to pack up, move to the middle of nowhere and stay put. Despite giving away 10% of all land in the United States, the government retained the most valuable part. For 163 years, it’s held on to it. This massive asset will form the core of Trump’s Sovereign Wealth Fund. That land and its mineral resources is a massive $150 trillion asset owned by the U.S. government.

It’s currently held on deposit across all 50 states. Do you remember when Trump spoke about new American cities? A year or so ago he mentioned America could build as many as 10 new “Freedom Cities.”

Trump said: “These freedom cities will reopen the frontier, reignite American imagination, and give hundreds of thousands of young people and other people, all hardworking families, a new shot at home ownership and in fact, the American dream.”

CNN made fun of his plan, calling it “light on details.” And Forbes piled on too, saying, “There are a lot of problems with this idea.”

Why did so many new cities spring to life during the 19th and early 20th century?

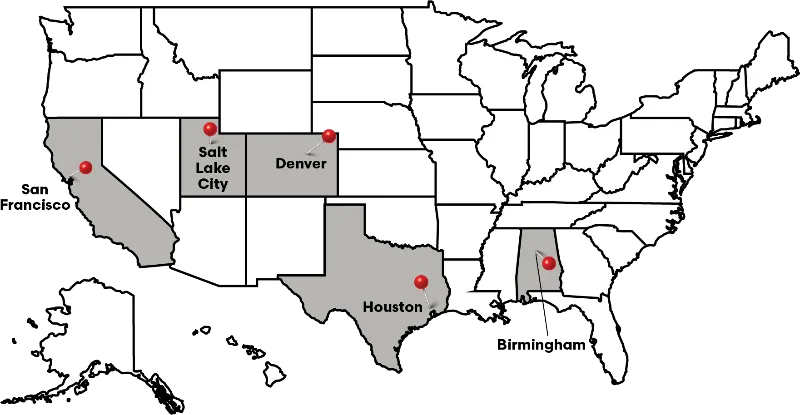

San Francisco didn’t become a city until the gold rush of 1849. And tens of thousands of speculators joined the fray.

Birmingham, Alabama was a quiet cotton-picking district. Until they discovered vast deposits of iron, coal and copper in the 1870s. Overnight, it became known as “The Magic City.”

Denver was sparsely populated until the late 1800s. Then, it burst to life thanks to gold fever and the birth of the transcontinental railroad.

Houston was known as “Mexican Texas.” But all that changed in 1901 – with the discovery of the giant oil field, Spindletop.

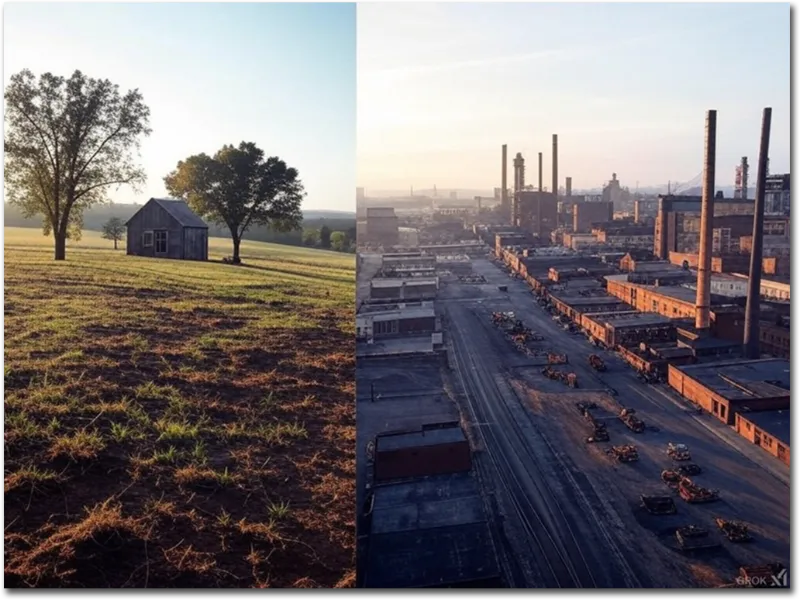

An explosion of mineral wealth rained down over our nation…and anyone of modest means could stake a claim and strike it rich. Trump’s new “freedom cities” and “mining boom” will do the same thing!

So many people cashed in… a phrase was invented to describe it:

“Rags to riches.” And now, it’s about to happen, once again.

These seemingly obscure minerals, from gold to copper and silver to lithium, they’re the building blocks of everything from NVIDIA Chips to advanced military weapons… to ChatGPT AI … to the new “freedom cities” that Trump has proposed.

Why hasn’t anyone built a new city in years? It takes vast amounts of wealth to build a new city. Not just dollars and cents. REAL mineral wealth. The building blocks of life. And unfortunately, the government got in the way with endless regulations.

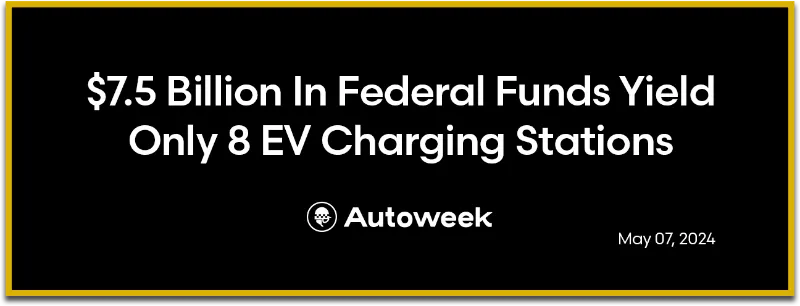

For the past 50 years, Washington DC has placed roadblocks on building and backed all kinds of crazy things, from electric cars and solar panels to offshore windmill farms - all in the hope that these technologies would “save the planet.” But they’ve been a disaster. They cost us trillions of dollars and make next to zero impact on the climate.

And all these regulations made it next to impossible to tap into our vast resources, here in the U.S.

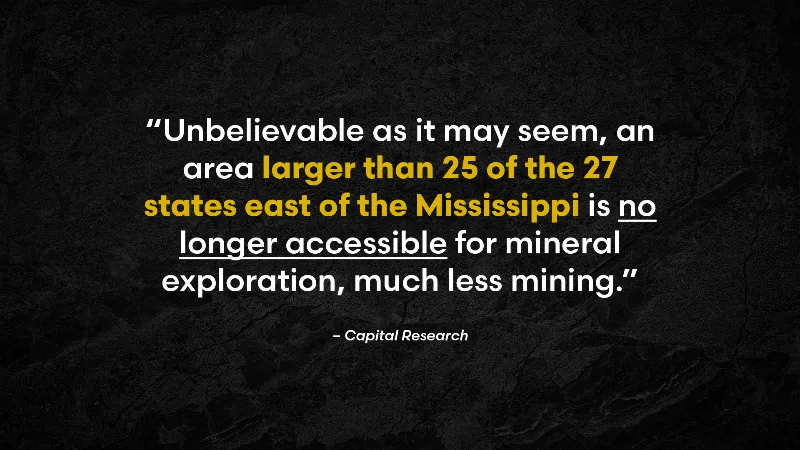

One former insider at the Department of the Interior said: “[We have] all these essential materials right under our feet. Incredibly, insanely, however the United States is the only nation in the world that locks them up.”

All these minerals have been “locked up” by environmentalists – for decades.

To protect the “environment” they destroyed our middle class. They shipped our key industries overseas. Then bottled-up America’s most valuable resources.

That’s equal to every square mile of ALL these states, COMBINED!

Maine

Vermont

New Hampshire

Massachusetts

Rhode Island

Connecticut

New York

Pennsylvania

New Jersey

Maryland

Delaware

Michigan

Ohio

Illinois

Indiana

Kentucky

West Virginia

Virginia

North Carolina

South Carolina

Tennessee

Mississippi

Alabama

Georgia

Florida

So, all this time – we’ve had this rich “endowment” right under our feet. Yet for years, we refused to touch it - until Trump came along.

Now, I’m not saying the government will give any of this money directly to American citizens. No one knows exactly how they’ll use this Fund. Or what will go inside it. But there are clues.

Treasury Secretary Scott Bessent said, “We’re going to monetize the asset side of the U.S. balance sheet. This has NEVER happened before. What could he mean by that?

Our untapped mineral resources right here at home are worth more than $150 trillion!

We currently rely on China for 100% of 20 key minerals. These are critical to everything from NVIDIA’s A.I. Chips to Elon Musk’s EVs, robots and satellites… to advanced military weaponry like F-16 fighters and drones. Practically every device with an “on” button.

And late last year, China cut us off!

China blocked the export of these critical minerals to the United States. But we have them right here at home, right under our feet. We’ve been sitting on a fortune. All the resources we could possibly need.

PRESIDENT TRUMP: “There are certain areas where we have great, raw earth. And we’re not allowed to use it because of the environment. We have areas that have incredible [resources] and I’m going to open them up. I’m going to let them use it.”

So today, for the first time in a century, he’s re-opening our mineral-rich Federal Lands and the American people will be able to INVEST IN THEM through his new SWF.

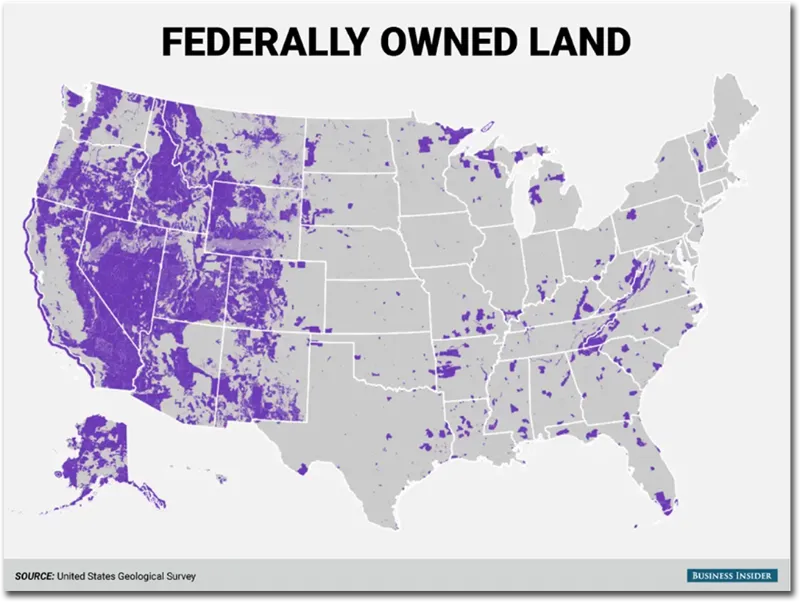

You can see on this map – the shaded area – it belongs to the public. It adds up to roughly 28% of all land in the U.S. About 90% of this land is concentrated out west. And it contains world-class mineral deposits, many of which have never been touched.

How can Trump do this?

For decades, there’s been a law on the books. The Chevron Doctrine. Its purpose was to prevent businesses from operating in America.

Have you ever wondered what happened to our shipbuilding industry? Our consumer electronics industry? Clothing and furniture makers? America used to be a bustling economy – full of hard working, innovative businesses. But most of them disappeared…thanks to a web of insane rules and regulations.

Most of them outsourced their labor to China. If you ever wondered why it’s so cheap to make a product way over there… and ship it thousands of miles back here. This is it. They don’t have all this red tape.

For the past 50 years, fake-experts have strangled us from within the government. They tied us down with reams of regulation. And they ushered in one boondoggle after another.

Like the “Green New Scam.” So they hollowed out our economy. And we wound up with toilets that can’t flush, gas cans that don’t work, shower heads that barely spit water and annoying paper straws that disintegrate in your mouth.

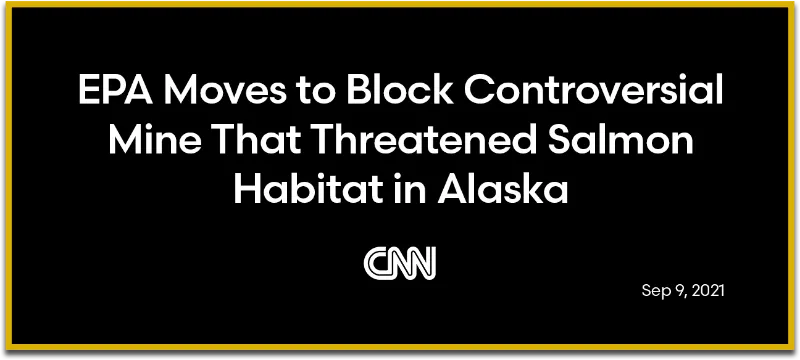

And these same bone-headed policies? They gave agencies like the EPA “kill shot” power to stop any mining project they wanted, at any time, for any reason.

It takes forever to “develop” anything in America. Trump can now change all that.

We have truly massive mineral wealth here. It’s not hard to extract. We know where it is. And how to get it. But the government got in the way.

There’s a huge copper deposit in Arizona. It’s called Resolution Mine. And it’s been sitting there for 29 years. It’s got enough copper to supply 25% of what we need, right here in America.

Then there’s the infamous Pebble mine in Alaska. It’s one of the greatest sources of mineral wealth ever discovered. Yet it’s been mothballed since 1990!

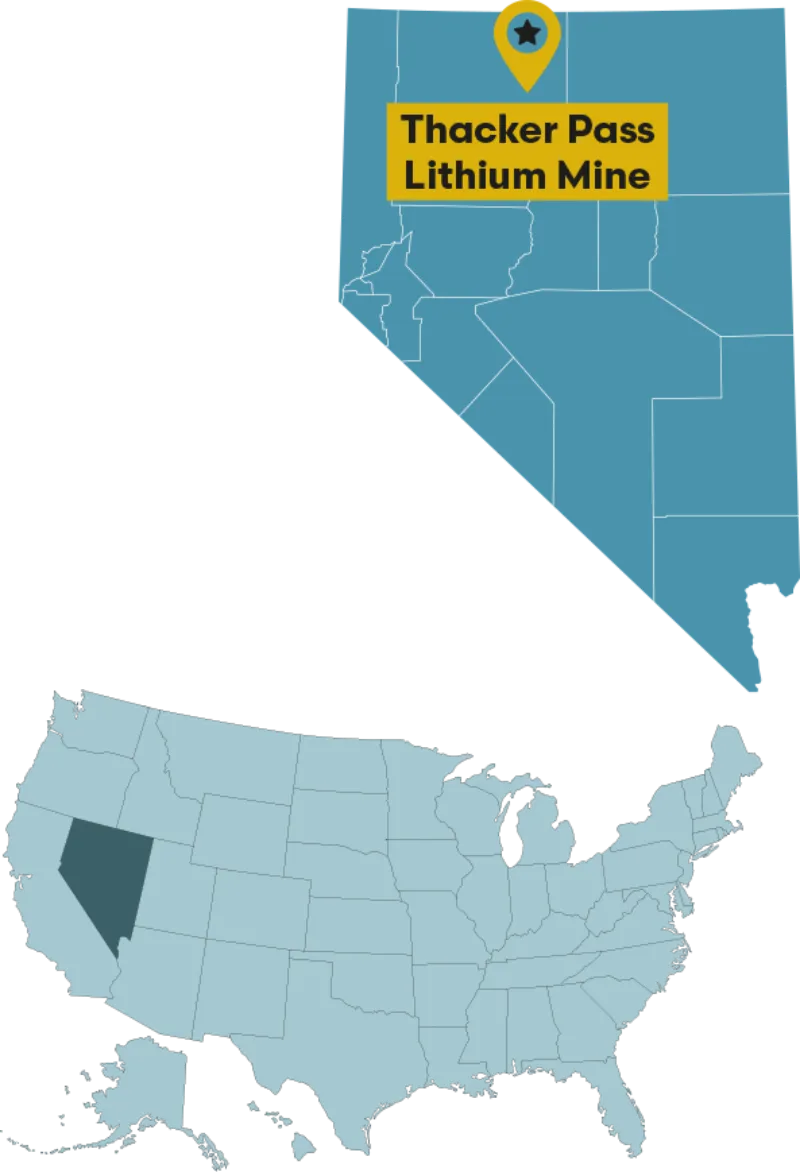

The Thacker Pass Lithium Mine in Nevada is the largest known deposit of its kind in the U.S.

It’s been shut down since 1978!

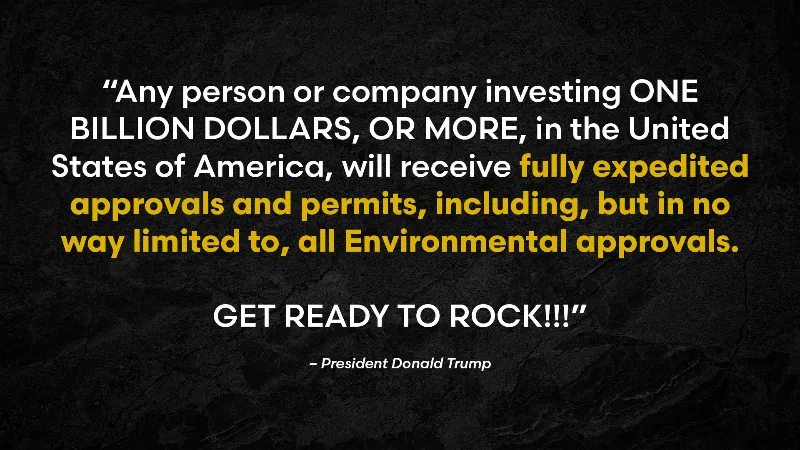

Not only is the Chevron Doctrine dead, but its vast power now lies with the Trump administration. These are public lands. But to unleash all this mineral wealth, the government is turning to investors. Trump is rolling out the red carpet, as we speak.

All Americans will eventually be able to profit from mineral rights tied to the most valuable untapped deposits in America due to Trump’s SWF.

Recently Trump’s Secretary of Commerce, Howard Lutnick said: “[We’re] going to rename The Department of the Interior - The Department of Land and Mineral Rights.”

For the first time in our lifetime, the government is going to monetize America’s real, physical wealth. Not just our gold reserves. But all our federal lands and along with the priceless metals and resources hidden under the surface.

We will see 50 years of trapped mineral wealth unleashed in a single presidential term.

The U.S. Government has blocked us from tapping into our Birthright. Trillions of dollars of minerals and metals, right here on American soil. Trump is shredding the government’s crazy rules and regulations.

His massive 10-to-1 deregulation initiative is sure to clear the way for miners and drillers to finally access our untapped resources.

The Supreme Court has reversed a decades long ban. And he’s issued multiple executive orders to unlock our vast energy resources. And establish America’s first Sovereign Wealth Fund.

The last time the government allowed regular Americans to tap into our vast endowment was 1872. That’s when Congress and President Ulysses S. Grant changed Title 30 of the U.S. Code and established this secret trust for the American people. Back then, anyone could make a claim. All you had to do was pay $2 to $5 per acre… and do a minimal amount of work.

Again, so many people cashed in on this… a phrase was invented to describe it: “rags to riches.”

That’s why big investors are pouring money into this corner of the market. That’s why I think Trump has acknowledged crypto as a viable investment tool because he will allow it to be used to invest in America’s growth.

Chances are, the billionaire class sees what Trump is doing and want to be a part of it. So they’re moving a mountain of money to get in front his plan.

In addition to unlocking our vast $150 trillion mineral endowment – I believe Trump is going to re-set the clock on our republic. And return us to something known as the “American System.”

The American System dates to the late 1700s. And it was supported by George Washington, Abraham Lincoln, all the way up to Dwight Eisenhower. You’ve heard Trump talk about getting rid of the IRS. And axing the income tax. We didn’t have an income tax for much of our history. Instead, the government drew revenue from tariffs.

Tariffs instead of taxes. That’s a pillar of Trump’s policy.

Recently, Trump said: “It’s time for the United States to return to the system that made us richer and more powerful than ever before.” The “American System.”

That’s why Trump has proposed a new agency called the External Revenue Service.

A new branch of Treasury focused on protecting American jobs and raising revenue by taxing our trade partners, instead of the American public.

Trump has also opened the door to revive the Keystone XL pipeline. Trump is also planning to re-fill our Strategic Petroleum Reserve. To refill our stockpile, Trump’s going to increase oil production here at home. And that’s only the start. As we return to the American System – we’re going to see a whole lot more than oil and gas produced in America. Trump’s plan is to increase U.S. oil production by 3 million barrels per day. Trump is applying immense pressure on U.S. companies to re-shore the production of everything from auto parts to A.I. chips. It’s all coming back. In order to fuel all this growth - we need to triple our energy resources!

What will happen after Trump regains control of the Panama Canal? Or negotiates a deal to make Greenland a U.S. Territory? Not to mention, the new $500 billion A.I. project, called Stargate or the new Golden Dome. What assets will be funneled into American’s new Sovereign Wealth Fund? Fortunes will be made from each of these events.

Today, our military is a mess. The Air Force is still flying B-52 bombers, built in 1961.

And it’s not just our planes that are out of date. Everything from ships to tanks – they’re 30-40 years old. But here’s the thing…

Trump isn’t going to remake the military of the past. He’s building a new one – supported by the most advanced technology on earth, including the just announced “Iron Dome.”

One company is working to replace the old Minuteman system, which dates to the 1960s – before we even set foot on the moon. It’s partnering with Elon Musk’s SpaceX to develop something called Star Shield. This tech is built on Elon’s Starlink platform. And it will act as an early warning system for America. And that’s just one of several firms poised to profit from Trump’s new Iron Dome.

The big question is – will America follow in the footsteps of Saudi Arabia? Will we offer subsidized, interest-free mortgages? Will we use this windfall to slash taxes or get rid of the income tax, entirely? Nobody knows. We’ll have to wait for Trump’s plan - which I hear is almost ready for publication.

Some U.S. states, most notably Alaska, already operate their own sovereign wealth funds. The Alaska Permanent Fund, for example, is a $79.6 billion fund (as of December 2024) that pays annual dividends to eligible residents.

A U.S. federal sovereign wealth fund is in the proposal and planning stages, with no current means for individuals to invest directly. Americans may benefit indirectly if such a fund is established, through public dividends, lower taxes, or increased government spending. State-level funds, like Alaska’s, provide a model for how citizens can benefit directly, but participation is limited by residency.

Trump and his team have suggested the fund could be financed by leveraging the federal government’s direct holdings (estimated at $5.7 trillion in assets) and possibly liquidating public lands and federal properties. There was a brief publication of over 400 government properties for sale, including major federal buildings.

Trump has floated the idea that the SWF could even be used for strategic acquisitions, such as purchasing the social media platform TikTok.

Major Successful Sovereign Wealth Funds Worldwide

The largest and most successful sovereign wealth funds (SWFs) globally include:

Norway Government Pension Fund Global (Norway) – $1.74 trillion

China Investment Corporation (China) – $1.33 trillion

SAFE Investment Company (China) – $1.09 trillion

Abu Dhabi Investment Authority (UAE) – $1.06 trillion

Kuwait Investment Authority (Kuwait) – $1.03 trillion

Public Investment Fund (Saudi Arabia) – $925 billion

GIC Private Limited (Singapore) – $800 billion

Qatar Investment Authority (Qatar) – $526 billion

Hong Kong Monetary Authority Investment Portfolio (Hong Kong) – $514 billion.

Norway’s fund is the largest, fueled by oil and gas revenues, and is often cited as a global benchmark. I find it interesting that Trump made it a point to meet with most of these countries in his first days in office. No coincidence.

Sovereign wealth funds benefit their countries and citizens in several key ways:

Long-Term Wealth Preservation: SWFs invest surplus revenues (often from natural resources or trade surpluses) into diversified global assets, building a capital base that preserves and grows national wealth for future generations.

Fiscal Stabilization: These funds act as buffers during economic downturns, providing governments with resources to stabilize budgets and maintain public spending when revenues fall—helping to avoid severe austerity measures.

Economic Development: SWFs can invest in domestic infrastructure, education, healthcare, and other public goods, directly improving quality of life and supporting long-term growth.

Pension and Social Program Funding: In some cases, returns from SWFs are used to fund pensions and social programs, reducing the need for higher taxes or borrowing.

Reducing Economic Volatility: By smoothing out the impact of volatile commodity prices (such as oil), SWFs help stabilize national economies and protect citizens from sudden shocks.

Strategic Investments: SWFs can support national priorities by investing in sectors crucial for future competitiveness, such as technology, clean energy, and advanced manufacturing.

In theory, a SWF could be structured to allow direct public investment or ownership. For example:

The government could issue shares or units in the SWF that citizens could buy and sell, similar to how some mutual funds operate.

The SWF could be set up as a public trust or fund with units allocated to citizens, as seen in Alaska’s Permanent Fund, which pays dividends directly to residents based on the fund’s performance (though citizens do not directly invest or control the fund).

Legislation would be required to enable such a structure, ensuring clear governance, transparency, and protections for both the fund and its citizen-investors.

In summary, successful sovereign wealth funds provide financial stability, support economic growth, and ensure that a nation’s wealth is managed for the long-term benefit of its citizens. How will ours benefit America and how can American citizens get involved? I’m excited to see what Bessent & Lutnick come up with for our SWF.

My work is free and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

If you like my work, you can fund me by becoming a paid subscriber on Substack or donate by credit card here. My preference is that you donate to me by check - made out to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801. Or, just send me a note or a card - I try to respond to all! I love hearing from you.