I was going to write about something else today but there are way too many lies floating around about Trump’s One Big Beautiful Bill (OBBB) that need to be corrected.

Elon Musk gave an interview to CBS that will air this Sunday on the morning shows. In it, he appears to be mocking Trump’s “One Big Beautiful Bill” - the OBBB - using the same dishonest talking points against it as the Koch Libertarians and RINOs (Massie, Paul, Murkowski & Collins) and leftists are. I find that very disturbing and telling.

MUSK: “I think a bill can be big or it can be beautiful. But I don’t know if it can be both. I was disappointed to see the massive spending bill, frankly, which increases the budget deficit, not just decreases it, and undermines the work that the DOGE team is doing.”

Musk is bashing the OBBB based on a lie and spewing the same talking points as Koch Libertarians like Massie & Paul. The OBBB is a reconciliation bill, DOGE cuts are to discretionary spending and Senate budget rules stipulate that you can NOT cut discretionary spending (only mandatory) in a reconciliation bill.

One of the few people I trust in politics is Stephen Miller. He is rigorously honest and I’ve never caught him in a lie. Here’s what he had to say about Elon’s flippant comments and the truth about the process.

STEPHEN MILLER: “I’ve seen a few claims making the rounds on the One Big Beautiful Bill that require correction.

The first claim is that it doesn’t “codify the DOGE cuts.” A reconciliation bill, which is a budget bill that passes with 50 votes, is limited by senate rules to “mandatory” spending only — eg Medicaid and Food Stamps. The senate rules prevent it from cutting “discretionary” spending — eg the Department of Education or federal grants.

The DOGE cuts are overwhelmingly discretionary, not mandatory. The bill saves more than 1.6 TRILLION in mandatory spending, including the largest-ever welfare reform. A remarkable achievement.

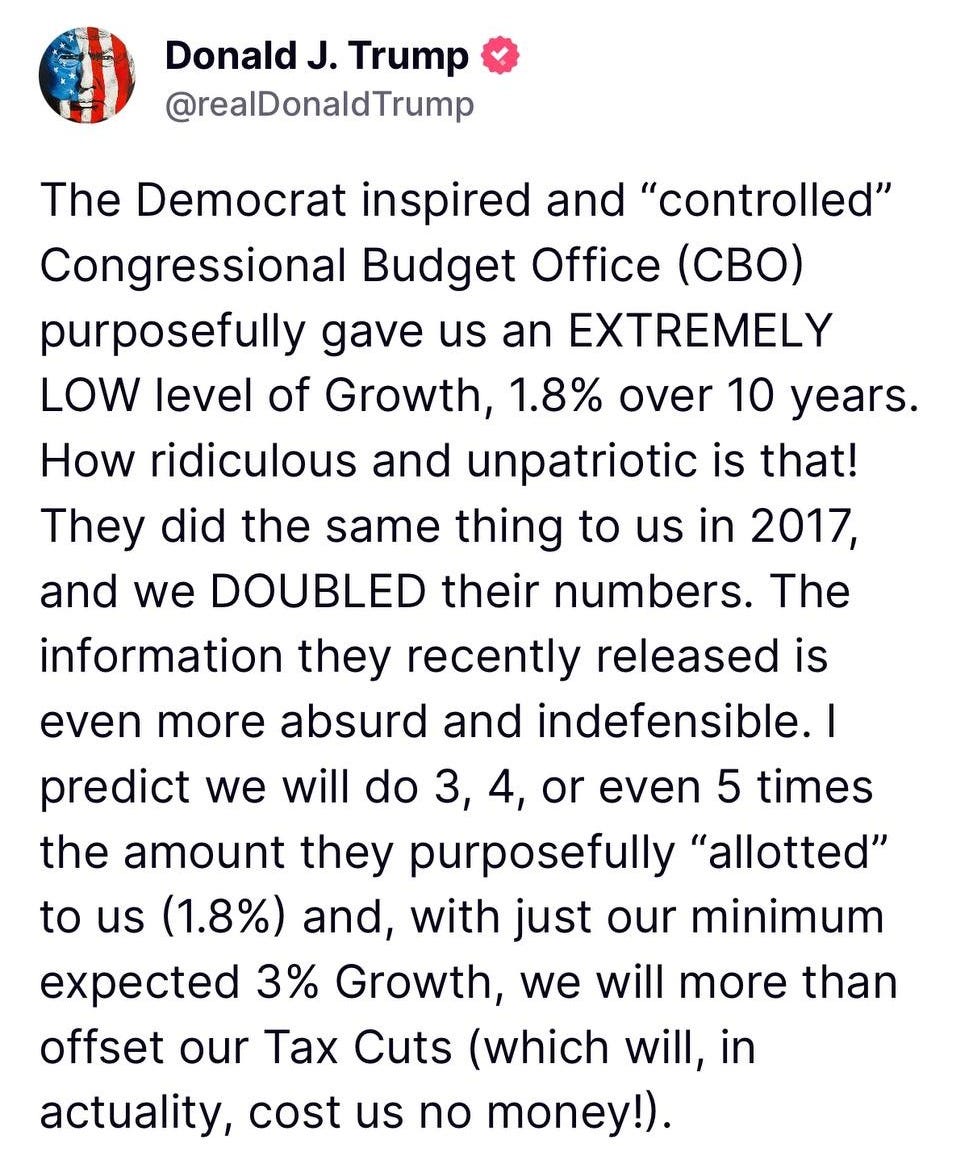

I’ve also seen claims the bill increases the deficit. This lie is based on a CBO accounting gimmick. Income tax rates from the 2017 tax cut are set to expire in September. They were always planned to be permanent. CBO says maintaining *current* rates adds to the deficit, but by definition leaving these income tax rates unchanged cannot add one penny to the deficit. The bill’s spending cuts REDUCE the deficit against the current law baseline, which is the only correct baseline to use.

Another fantastically false claim is that the bill spends trillions of dollars. This is just completely invented out of whole cloth. This is not a ten year budget bill—it doesn’t “fund” almost any operations of government, which are funded in the annual budget bills (which this is not).

In other words, if this bill passed, but the annual budget bill did not, there would be no government funding. Under the math that critics are using, if we passed a one paragraph reconciliation bill that cut simply 50 billion in food stamp spending, they would say the bill “added” trillions in spending and debt because they are counting ALL the projected federal spending that exists entirely outside the scope of this legislation, which is of course preposterous.

The only funding in the bill is for the President’s border and defense priorities, while enacting a net spending cut of over 1.6 TRILLION dollars. The bill has two fiscal components: a massive tax cut and a massive spending cut.

The Big Beautiful Bill is NOT an annual budget bill and does not fund the departments of government. It does not finance our agencies or federal programs. Instead, it includes the single largest welfare reform in American history. Along with the largest tax cut and reform in American history. The most aggressive energy exploration in American history. And the strongest border bill in American history. All while reducing the deficit.”

DAVID SACKS: “First, reconciliation bills only deal with “mandatory spending,” not “discretionary spending.” Since the DOGE cuts apply to discretionary spending, they will have to be dealt with separately. To be clear, I will be very disappointed if the DOGE cuts aren’t codified. But according to Senate rules, that has to happen through a different vehicle.

Second, the OBBB does actually cut spending. It’s just not scored that way because the bill removes the sunset provision from the 2017 tax cuts. In other words, the bill *continues* tax rates that have been in place since January 1, 2018 but CBO scores this as a spending increase because those rates would have expired on December 31, 2025.

If you use the current year as a baseline, as common sense would tell you to do, BBB represents a cut in net spending. Undoubtedly there are things that could be improved about the bill, but Republicans only had a 1-vote margin in the House to work with. Now let’s hold their feet to the fire because we do need the DOGE cuts to be made permanent and for that critical work to continue.”

KEITH SELF: “The Trump Tax Cuts included in the bill will make permanent the largest tax cut in American history for middle and working-class Americans. The significance of getting these signed into law cannot be overstated. Codifying and delivering this top campaign promise of President Trump will put an extra $5,000 in the pockets of hardworking Americans, will deliver relief for small businesses, families, farmers, and seniors, and will incentivize Made in America investments. Once the Trump Tax Cuts are signed into law, the American economy will soar like we’ve never seen.”

PETER NAVARRO: “In making its projections, the CBO [Congressional Budget Office] has refused to account for — or ‘score’ as they say in CBO lingo — any of the new revenues from the Trump reciprocal tariffs.

Remember here a key goal of Trump’s fair-trade policies is to shift the U.S. tax base from one primarily reliant on income taxes to one that, with the vision of the new External Revenue Service, is also supported by tariff revenues. Consider, then, the impacts on the CBO’s projected revenue shortfall of just the modest 10 percent global baseline tariff Trump recently put into effect.

Such a tariff, depending on consumer responses (as measured by demand elasticities) and enforcement efficacy (i.e., how much cheating occurs), should generate between $2.3 trillion and $3.3 trillion in additional revenue over the ten-year forecast period.

When this revenue is layered onto the enhanced dynamic growth scenario, the projected budget impact from the One Big Beautiful Bill Act ranges from a modest $300 billion increase in the debt under the 2.2 percent growth assumption to as much as a $2 trillion surplus under the 2.7 percent growth assumption.”

PRESIDENT TRUMP: “THE ONE, BIG, BEAUTIFUL BILL” has PASSED the House of Representatives! This is arguably the most significant piece of Legislation that will ever be signed in the History of our Country! The Bill includes MASSIVE Tax CUTS, No Tax on Tips, No Tax on Overtime, Tax Deductions when you purchase an American Made Vehicle, along with strong Border Security measures, Pay Raises for our ICE and Border Patrol Agents, Funding for the Golden Dome, “TRUMP Savings Accounts” for newborn babies, and much more!

Great job by Speaker Mike Johnson, and the House Leadership, and thank you to every Republican who voted YES on this Historic Bill!

Now, it’s time for our friends in the United States Senate to get to work, and send this Bill to my desk AS SOON AS POSSIBLE! There is no time to waste. I want the Senate and the Senators to make the changes they want. It will go back to the House and we’ll see if we can get them. In some cases, the changes may be something I’d agree with, to be honest.”

MIKE JOHNSON: “Elon Musk and the entire DOGE team have done INCREDIBLE work exposing waste, fraud, and abuse across the federal government - from the insanity of USAID’s spending to finding over 12 million people on Social Security who were over 120 years old. The House is eager and ready to act on DOGE’s findings so we can deliver even more cuts to big government that President Trump wants and the American people demand.

We will do that in two ways: 1. When the White House sends its rescissions package to the House, we will act quickly by passing legislation to codify the cuts. 2. The House will use the appropriations process to swiftly implement President Trump’s 2026 budget. In the meantime, we have been working around the clock as we prepared for those processes.

Stephen Miller has made an important point about the two efforts: DOGE found savings in discretionary spending (such as funding agencies), while our One Big Beautiful Bill secured over $1.6 trillion in savings in mandatory spending (such as Medicaid). Both are HISTORIC and take HUGE steps toward addressing our debt and deficit.”

RUSS VOUGHT: “Critics have attacked the One Big Beautiful reconciliation bill on fiscal grounds, but I think they are profoundly wrong. It is truly historic. As a nation, we have had no spending cut victories of any consequence in nearly thirty years. In 1997, the Balanced Budget Agreement included roughly $800 billion in mandatory savings adjusted for inflation.

The current House bill includes $1.6 trillion in savings. These are not gimmicks but real reforms that lower spending and improve the programs. The bill satisfies the very red-line test that House fiscal hawks laid out a few weeks ago that stated that the cost of any tax cut could be paid for with $2.5 trillion in assumed economic growth, but the rest had to be covered with savings from reform. This bill exceeds that test by nearly $100 billion.

So after nothing happening for decades, the House bill provides a historic $1.6 trillion in mandatory savings...with a three-seat majority. $36 trillion in debt is not solved overnight. It is solved by advancing and securing victories at a scale that over time, gives a fighting shot to addressing the problem.

The House's One Big Beautiful Bill deserves passage for many reasons...tax cuts, border security funding, eliminating the Green New Deal, work requirements to end dependency...but it should not be lost on anyone, the degree to which it ends decades of fiscal futility and gets us winning again. It deserves the vote of every member of Congress.”

BESSENT: “We've inherited a 6.7% deficit-to-GDP, the highest outside war or recession. Our focus is to grow the economy faster than the debt, that’s how we will stabilize debt-to-GDP. Let’s pass President Trump's ONE BIG, BEAUTIFUL BILL, lower the burden on working families and businesses, and drive economic growth.”

Remember, the "One Big Beautiful Bill" (OBBB) only passed the U.S. House of Representatives by one vote - with the final tally at 215-214.

Two House Republicans showed they are "grandstanders" and voted against the bill:

Thomas Massie (Kentucky)

Warren Davidson (Ohio)

Additionally, Andy Harris (Maryland), chair of the House Freedom Caucus, voted "present," signaling disapproval without formally voting against the bill.

Two other Republicans, David Schweikert (Arizona) and Andrew Garbarino (New York), did not vote. Both were reported to have missed the vote unintentionally and indicated they would have supported the bill if present so the vote would have been 217-214.

The OBBB makes permanent the 2017 Trump tax cuts and introduces new tax relief measures for families, small businesses, and seniors.

The bill now moves to the Senate. The Senate is expected to begin crafting its own version of the legislation after returning from the Memorial Day recess, likely starting the week of June 2. Congressional leaders have stated their goal is to send the bill to President Trump’s desk by July 4.

Here are 20 reasons why Congress must unite behind the One, Big, Beautiful Bill:

It delivers the largest tax cut in American history. This means an extra $5,000 in Americans’ pockets with a DOUBLE-DIGIT percent DECREASE to their tax bills. Americans earning between $30,000 and $80,000 will pay around 15% less in taxes.

It includes NO TAX ON TIPS and NO TAX ON OVERTIME. This makes good on two of President Trump’s cornerstone campaign promises and will benefit hardworking Americans where they need it the most — their paychecks.

It delivers Big, Beautiful Deportations. The bill permanently secures our borders by making the largest border security investment in history, funding at least one million annual removals of illegal immigrants and ramping up “mass deportation operations to a level never before seen in American history.”

It finishes President Trump’s border wall. As a result, 701 miles of primary wall, 900 miles of river barriers, 629 miles of secondary barriers, and 141 miles of vehicle and pedestrian barriers will be constructed — stopping deadly fentanyl from flowing into our communities and securing the border from dangerous illegal immigrant murderers and rapists.

It boosts Border Patrol and ICE agents on the frontlines. It empowers immigration authorities to carry out their mission by hiring 10,000 new ICE personnel, 5,000 new customs officers, and 3,000 new Border Patrol agents — and gives $10,000 bonuses in each of the next four years to agents on the frontlines.

It protects Medicaid for Americans by kicking 1.4 million illegals off the benefits. This bill eliminates waste, fraud, and abuse by ending benefits for at least 1.4 million illegal immigrants who are gaming the system.

It requires able-bodied Americans to work if they receive benefits. With 4.8 million able-bodied adults choosing not to work, The One, Big, Beautiful Bill puts work requirements in place and supports them as they find dignity through employment.

It reverses the spending curse plaguing Washington, D.C. The legislation delivers the largest deficit reduction in nearly 30 years, with $1.6 trillion in mandatory savings.

It ends taxpayer-funded sex change for minors. It reverses the Biden-era mandate that Medicaid cover so-called “gender transition” procedures for minors — ending the taxpayer-funded chemical castration and mutilation of American children.

It provides historic tax relief to Social Security recipients. It slashes taxes on seniors’ Social Security benefits.

It will give Americans PERMANENT tax relief through the Trump Tax Cuts. If the bill doesn’t pass, Americans will see the largest tax increase in history.

It finally modernizes air traffic control, fulfilling President Trump’s plan to completely overhaul the systems that keep Americans flying safely and efficiently. This will allow President Trump to update our air traffic control systems and act where the Biden Administration failed (despite repeated warnings).

It ends the taxpayer-funded Green New Scam. The legislation repeals or phases out every “green” corporate welfare subsidy in Democrats’ so-called “Inflation Reduction Act,” immediately stops credits from flowing to China and saves taxpayers $500+ billion every year, and reverses electric vehicle mandates that let radical climate activists set the standards for American energy.

It incentivizes MADE IN AMERICA. It rewards companies that build their products in America with lower taxes — and allows Americans who buy an American-made vehicle to fully deduct their auto loan interest.

It is pro-family. The One, Big, Beautiful Bill increases the child tax credit, establishes MAGA Accounts for newborns to start saving, and strengthens paid family leave.

It repeals Democrats’ insane attack on the gig economy. It repeals the requirement that Venmo, PayPal, and other gig transactions over $600 be reported to the IRS.

It protects family farmers. The bill prevents the greedy death tax from hitting two million family-owned farms who would otherwise see their exemptions cut in half and cuts taxes on farmers by over $10 billion.

It’s a once-in-a-generation chance to revolutionize our nation’s defense capabilities and protect the homeland against new threats. It funds President Trump’s Golden Dome, invests in American shipbuilding, and modernizes our military.

It unleashes American energy dominance. The legislation increases onshore and offshore oil and gas leases, which provides certainty for energy producers, spurs job growth, and makes energy more affordable for American consumers.

It boosts American mineral development. This bill increases mining of domestic minerals and makes America less dependent on foreign adversaries for critical minerals.

It maintains our status as the Worldwide Leader in WiFi, 5G, and 6G, connecting every American to the World’s BEST Networks, while also keeping everyone safe.

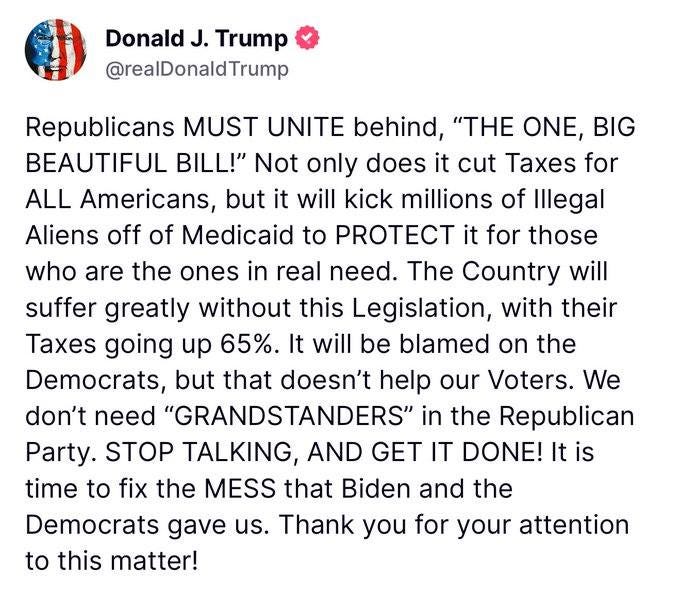

PRESIDENT TRUMP: “If the OBBB doesn't get approved, this country is going to have a 65% increase in taxes and lots of other problems, big problems. We'll have a 65% increase in taxes, as opposed to the largest tax cut in the history of our country.”

KEVIN HASSETT: "If Republicans in the Senate don't pass the big, beautiful bill, then we're going to see the biggest tax hike as the previous tax cuts expire...the biggest tax hike that we've ever had in US history. If we have that tax hike, the Council of Economic Advisers here at the White House has estimated that we'll have a recession, a really deep recession with maybe a decline of 4% of GDP."

My work is free and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

If you like my work, you can fund me by becoming a paid subscriber on Substack or donate by credit card here. My preference is that you donate to me by check - made out to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801. Or, just send me a note or a card - I try to respond to all! I love hearing from you.