Remember when Obama & Koch-funded guys like Peter Schiff said there's no way to bring business back to America? They were wrong. President Trump’s SAVE AMERICA plan is working already and the CCP is crumbling.

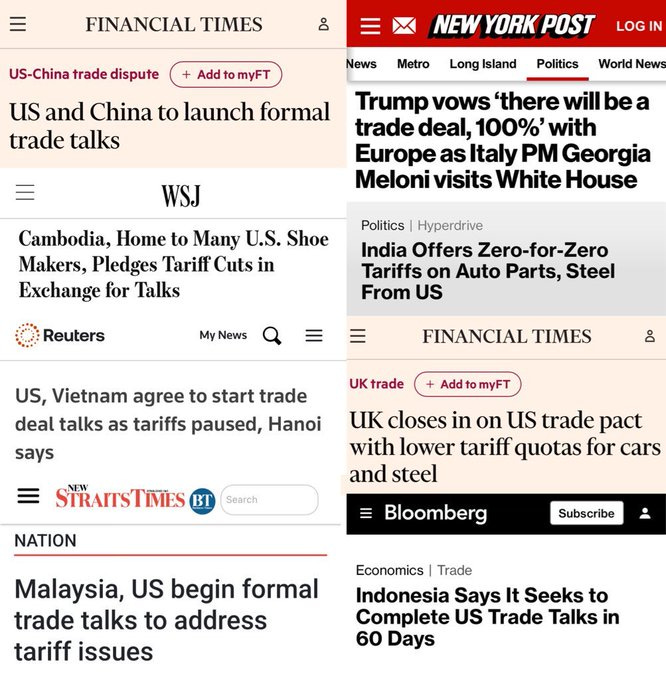

American manufacturers are seeing a surge in demand as President Trump’s tariffs force companies to reconsider doing business in China.

Trump’s tariffs on Chinese goods are causing American-made products to be more competitive in the market. As a result, many small and medium manufacturers are experiencing a surge in demand and are preparing to ramp up production and hire new workers. The Wall Street Journal and the Washington Post report:

Jergens Inc., a midwestern toolmaker with less than 500 employees, says it’s “going like gangbusters” trying to keep up with demand. They are seeing an influx of orders from customers trying to avoid import tariffs.

“We are running 24 hours a day, seven days a week. We are swamped.”

Grand River Rubber & Plastics, a plastics and rubber manufacturer in Ohio, says customers that once offshored to China are reversing course. Two buyers who left years ago returned within days of each other and two new oil filter manufacturers have already placed orders. Their business is already up 10% in one month.

Employees for Massachusetts-based AccuRounds are working overtime to accommodate rising orders for the company’s shafts, valves and other steel components. The company recently added two customers that had shifted business from AccuRounds to suppliers in Singapore and China in recent years. First-quarter sales were 20% higher from a year earlier, said Chief Executive Michael Tamasi.

Michigan-based Whirlpool, which assembles 80% of its U.S. appliances at domestic factories, says its Asian competitors have had an unfair advantage, as they manufacture their appliances overseas but haven’t been paying import tariffs on them since 2023, when one imposed during Trump’s first term expired. Those rivals’ access to cheaper components and steel in Asia helps give them a $150 retail price advantage on washers, Whirlpool says. Chief Executive Marc Bitzer said the latest tariffs on imported assembled appliances should help close the price gap.

At the local Excel Dryer plant, William Gagnon, the chief operating officer, said tariffs have been nothing but good news for them. By making foreign goods more expensive, the tariffs make their American-made products competitive while also discouraging Americans from purchasing cheap Chinese copies of Excel’s hand dryers.

TRUMP: “Jobs and factories will come roaring back into our country, and you see it happening already. We will supercharge our domestic industrial base. We will pry open foreign markets and break down foreign trade barriers. And ultimately, more production at home will mean stronger competition and lower prices for consumers.”

BESSENT: "The president's signature tax legislation will prevent an enormous tax hike on Main Street by making the small business deduction permanent. It will also provide tax credits and deductions for research and innovation to stimulate investment in high-tech operations."

"The real idea is to make sure that innovators can innovate and steelworkers can have the same quality of life and opportunity, and their kids could be the Silicon Valley entrepreneurs, or they can stay and have the same life or better that their folks had in Pittsburgh."

"We will restore 100% expensing for equipment while expanding that incentive to new factory construction. The objective: to accelerate investment in American industry, and to make that investment as seamless and rewarding as possible. President Trump has embraced an ambitious deregulatory agenda. This includes expansive permitting reform, a president who doesn't want to just 'drill, baby, drill,' he wants to 'build, baby, build.'"

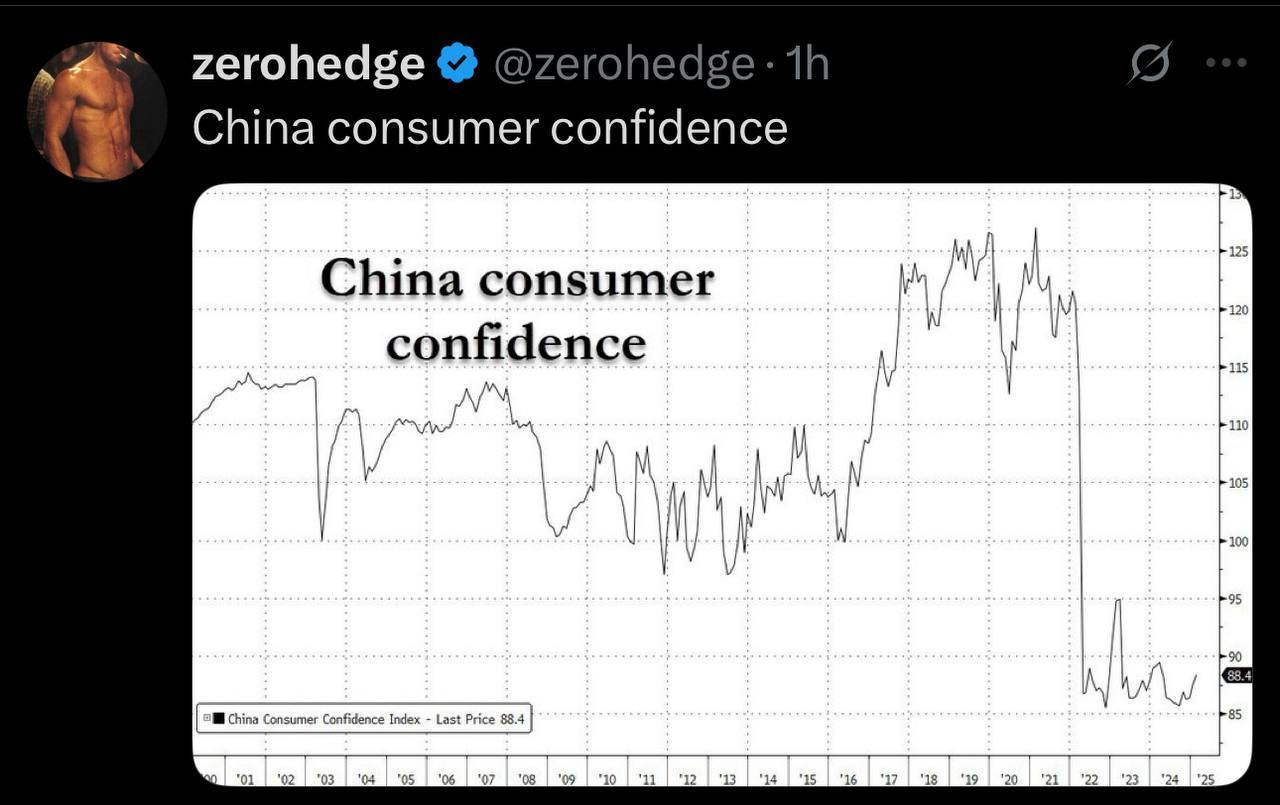

In the meantime, the CCP has actually STOPPED PUBLISHING financial information - and has likely been lying about their economy for almost 20 years. It's all smoke and mirrors.

All it took was for President Trump to shut off the flow of American money for cheap Chinese imports to show just how bad it really is.

BESSENT: Tariffs are working. China is in free fall. Factories are closing. CCP officials are ‘disappearing.' There are empty cargo ships loitering around ports. Protesters are demanding that Xi step down. Millions are out of work. Time is running out.

CHANG: A year ago, Xi Jinping thought he was the boss of the world. Now, he has lost control of his own country. China is on fire, and there is little Xi can do except try to buy some more time. Christmas season for Chinese factories is coming soon, and they could end up with no purchase orders from the U.S. The lack of orders would put enormous pressure on Xi Jinping to run up the white flag.

Vice Chairman of the Central Military Commission Zhang Youxia, China’s No. 1 uniformed officer and an adversary of Xi Jinping, is effectively running the People’s Liberation Army. Xi, from most indications, has lost control of the most important faction in the CCP. Workers across China are not being paid, and many have been laid off. They are now taking to the streets and the CCP is trying to hide evidence of those protests.

President Trump now has more influence over China’s future than Xi Jinping. The American president, with the power of tariffs, gets to decide whether the Chinese economy recovers or not, in other words, whether the regime survives or not.

TRUMP: We don’t have to waste money on a trade deficit with China for junk that we don’t need.

Here is a running list of new U.S.-based investments in President Trump’s second term:

Project Stargate, led by Japan-based Softbank and U.S.-based OpenAI and Oracle, announced a $500 billion private investment in U.S.-based artificial intelligence infrastructure.

Apple announced a $500 billion investment in U.S. manufacturing and training.

NVIDIA, a global chipmaking giant, announced it will invest $500 billion in U.S.-based AI infrastructure over the next four years amid its pledge to manufacture AI supercomputers entirely in the U.S. for the first time.

IBM announced a $150 billion investment over the next five years in its U.S.-based growth and manufacturing operations.

Taiwan Semiconductor Manufacturing Company (TSMC) announced a $100 billion investment in U.S.-based chips manufacturing.

Johnson & Johnson announced a $55 billion investment over the next four years in manufacturing, research and development, and technology.

Roche, a Swiss drug and diagnostics company, announced a $50 billion investment in U.S.-based manufacturing and research and development, which is expected to create more than 1,000 full-time jobs and more than 12,000 jobs including construction.

Bristol Myers Squibb announced a $40 billion investment over the next five years in its research, development, technology, and U.S.-based manufacturing operations.

Eli Lilly and Company announced a $27 billion investment to more than double its domestic manufacturing capacity.

United Arab Emirates-based ADQ and U.S.-based Energy Capital Partners announced a $25 billion investment in U.S. data centers and energy infrastructure.

Novartis, a Swiss drugmaker, announced a $23 billion investment to build or expand ten manufacturing facilities across the U.S., which will create 4,000 new jobs.

Hyundai announced a $21 billion U.S.-based investment — including $5.8 billion for a new steel plant in Louisiana, which will create nearly 1,500 jobs.

Hyundai also secured an equity investment and agreement from Posco Holdings, South Korea’s top steel maker.

United Arab Emirates-based DAMAC Properties announced a $20 billion investment in new U.S.-based data centers.

France-based CMA CGM, a global shipping giant, announced a $20 billion investment in U.S. shipping and logistics, creating 10,000 new jobs.

Venture Global LNG announced an $18 billion investment at its liquefied natural gas facility in Louisiana.

AbbVie announced a $10 billion investment over the next ten years to support volume growth and add four new manufacturing plants to its network.

Pratt Industries announced a $5 billion investment to create 5,000 new manufacturing jobs in Ohio, Michigan, Pennsylvania, and Arizona.

Thermo Fisher Scientific announced it will invest an additional $2 billion over the next four years to enhance and expand its U.S. manufacturing operations and strengthen its innovation efforts.

Merck & Co. announced it will invest a total of $9 billion in the U.S. over the next several years after opening a new $1 billion North Carolina manufacturing facility — including in a new state-of-the-art biologics manufacturing plant in Delaware, which will create at least 500 new jobs.

Clarios announced a $6 billion plan to expand its domestic manufacturing operations.

Stellantis announced a $5 billion investment in its U.S. manufacturing network, including re-opening its Belvidere, Illinois, manufacturing plant.

In addition to its overall investments, Amazon announced it is investing $4 billion in small towns across America, creating more than 100,000 new jobs and driving opportunities across the country.

Regeneron Pharmaceuticals, a leader in biotechnology, announced a $3 billion agreement with Fujifilm Diosynth Biotechnologies to produce drugs at its North Carolina manufacturing facility.

NorthMark Strategies, a multi-strategy investment firm, announced a $2.8 billion investment to build a supercomputing facility in South Carolina.

Kimberly-Clark announced a $2 billion investment to expand its U.S. manufacturing operations, including a new advanced manufacturing facility in Warren, Ohio, an expansion of its Beech Island, South Carolina, facility, and other upgrades to its supply chain network.

Chobani, a Greek yogurt giant, announced $1.7 billion to expand its U.S. operations.

$1.2 billion to build its third U.S. dairy processing plant in New York, which is expected to create more than 1,000 new full-time jobs.

$500 million to expand its Idaho manufacturing plant.

Corning announced it is expanding its Michigan manufacturing facility investment to $1.5 billion, adding 400 new high-paying advanced manufacturing jobs for a total of 1,500 new jobs.

GE Aerospace announced a $1 billion investment in manufacturing across 16 states — creating 5,000 new jobs.

Anduril Industries announced a $1 billion investment for a new autonomous weapon system facility in Ohio.

Amgen announced a $900 million investment in its Ohio-based manufacturing operation.

Schneider Electric announced it will invest $700 million over the next four years in U.S. energy infrastructure.

GE Vernova announced it will invest nearly $600 million in U.S. manufacturing over the next two years, which will create more than 1,500 new jobs.

Abbott Laboratories announced a $500 million investment in its Illinois and Texas facilities.

AIP Management, a European infrastructure investor, announced a $500 million investment to solar developer Silicon Ranch.

London-based Diageo announced a $415 million investment in a new Alabama manufacturing facility.

Dublin-based Eaton Corporation announced a $340 million investment in a new South Carolina-based manufacturing facility for its three-phase transformers.

Germany-based Siemens announced a $285 million investment in U.S. manufacturing and AI data centers, which will create more than 900 new skilled manufacturing jobs.

The Bel Group announced a $350 million investment to expand its U.S.-based production, including at its South Dakota, Idaho and Wisconsin facilities — which will create 250 new jobs.

Clasen Quality Chocolate announced a $230 million investment to build a new production facility in Virginia, which will create 250 new jobs.

Fiserv, Inc., a financial technology provider, announced a $175 million investment to open a new strategic fintech hub in Kansas, which is expected to create 2,000 new high-paying jobs.

Paris Baguette announced a $160 million investment to construct a manufacturing plant in Texas.

TS Conductor announced a $134 million investment to build an advanced conductor manufacturing facility in South Carolina, which will create nearly 500 new jobs.

Switzerland-based ABB announced a $120 million investment to expand production of its low-voltage electrification products in Tennessee and Mississippi.

Saica Group, a Spain-based corrugated packaging maker, announced plans to build a $110 million new manufacturing facility in Anderson, Indiana.

Hotpack, a Dubai-based maker of food packaging materials and related products, announced a $100 million investment to establish its first U.S. manufacturing facility in Edison, New Jersey.

Charms, LLC, a subsidiary of candymaker Tootsie Roll Industries, announced a $97.7 million investment to expand its production plant and distribution center in Tennessee.

Toyota Motor Corporation announced an $88 million investment to boost hybrid vehicle production at its West Virginia factory, securing employment for the 2,000 workers at the factory.

AeroVironment, a defense contractor, announced a $42.3 million investment to build a new manufacturing facility in Utah.

Paris-based Saint-Gobain announced a new $40 million NorPro manufacturing facility in Wheatfield, New York.

India-based Sygene International announced a $36.5 million acquisition of a Baltimore biologics manufacturing facility.

Asahi Group Holdings, one of the largest Japanese beverage makers, announced a $35 million investment to boost production at its Wisconsin plant.

Cyclic Materials, a Canadian advanced recycling company for rare earth elements, announced a $20 million investment in its first U.S.-based commercial facility, located in Mesa, Arizona.

Guardian Bikes announced a $19 million investment to build the first U.S.-based large-scale bicycle frame manufacturing operation in Indiana.

Amsterdam-based AMG Critical Minerals announced a $15 million investment to build a chrome manufacturing facility in Pennsylvania.

NOVONIX Limited, an Australia-based battery technology company, announced a $4.6 million investment to build a synthetic graphite manufacturing facility in Tennessee.

LGM Pharma announced a $6 million investment to expand its manufacturing facility in Rosenberg, Texas.

ViDARR, a defense optical equipment manufacturer, announced a $2.69 million investment to open a new facility in Virginia.

That doesn’t even include the U.S. investments pledged by foreign countries:

United Arab Emirates announced a $1.4 trillion investment in the U.S. over the next decade.

Saudi Arabia announced it intends to invest $600 billion in the U.S. over the next four years.

Japan announced a $1 trillion investment in the U.S.

Taiwan announced a pledge to boost its U.S.-based investment.

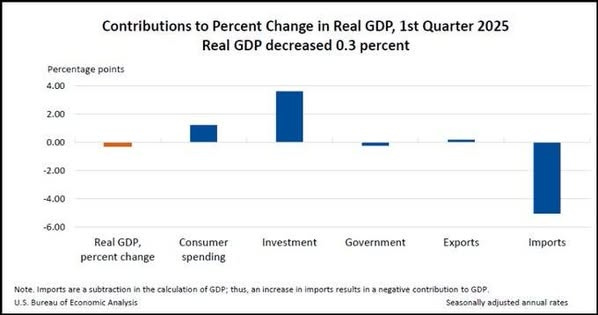

Finally, remember that ‘imports‘ REDUCE the economic equation called Gross Domestic Product. GDP is the valuation of all goods and services produced in the USA *minus* the value of imports.

In the first quarter 2025, importers cranked up shipments before Trump's tariffs kicked in. So GDP actually ROSE - not dropped. Koch stooges, who want open borders, like Rand Paul & Peter Schiff, are lying about this - GDP is going UP under Trump, NOT down.

It's the same word salad they use regarding tax cuts. Tax cuts are called SPENDING when they actually result in GROWTH. Don’t let them fool you with fake words. Investment in America is high and MAGA is working.

My work is free and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

If you like my work, you can fund me by becoming a paid subscriber on Substack, donate by credit card here or you can send me a check to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801- or just send me a note or a card! I love hearing from you.