Saving America - Part Seven (Monetizing Assets like Gold & Minerals)

This is Part 7 of my series on Trump’s plan to Save America.

Tucker did a long interview with a guy about all the gold flowing out of other countries into New York and the recent chatter about auditing Fort Knox. 10 days ago, I posted this on X:

BANKERS HAVE BEEN USING THE CARGO HOLDS OF COMMERCIAL AIRPLANES LATELY TO TRANSPORT PALLETS OF GOLD TO AMERICA OUT OF FEAR OF TRUMP'S TARIFFS.

TRUMP WANTS THE GOLD BACK HERE IN AMERICA SO THAT THE BRICS NATIONS AND THE EU CAN'T USE IT AND WE CAN. TARIFFS WILL HELP BRING IT BACK. THERE'S A REASON TRUMP IS CALLING HIS PLAN TO SAVE AMERICA THE "GOLDEN" AGE OF AMERICA.

INDEPENDENT: Deep under London’s streets lies an intricate network of tunnels holding the world’s second-largest depository of gold. The Bank of England’s nine heavily fortified vaults hold hundreds of tons of gold valued at more than $252 Billion. But now, they are slowly being emptied over fears of Trump’s tariffs. Traders are nervous that Trump will impose tariffs on gold. The U.S. bank JPMorgan and the U.K.’s HSBC are two of the biggest names flying the precious metal across the Atlantic to cover losses on short positions.

Traders are now nervous that Trump will impose tariffs on gold. Banks are, in essence, shorting the price of gold.

JPMorgan and HSBC – who have access to huge gold supplies in London – often lend out bullion to borrowers who need to use it as collateral. Interest is charged on the loan, with the banks hedging against price decreases by selling gold futures in New York.

Since Election Day, U.S. gold inventories have doubled. Jetting the gold using the cargo hold of commercial flights is the cheapest way to transport it.

The gold is first shuttled to the airport in high-strength vans before being sent to Swiss refiners to recast – due to Comex contracts requiring different bar sizing – it before flying on to the U.S.

FINANCIAL TIMES: “People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue. Liquidity in the London market has been diminished.”

“There is a feeling that Trump could go across the board and impose new tariffs on raw materials coming into the US, including gold. There is a bit of a scramble among participants in the gold market to protect themselves.”

GROK confirmed this was happening.

Was I right? What does this mean for the rest of us? Let’s start with Tucker’s interview which was clearly designed to convey a particular message.

I EDITED TUCKER’S INTERVIEW TO TAKE OUT SPIN AND JUST DEAL WITH THE FACTS. HERE ARE SOME KEY EXCERPTS.

We have moved on from gold as a unit of account. Our bank accounts aren't denominated in gold. We moved on from gold. I'm not walking around with gold coins in my pocket.

The global central banks who are running our currency and monetary system, as much as we have moved to fiat currency, as much as technology developed, as much as our economies have developed, they have always continued to hold their gold.

And in the last ten, 11 years, global central banks in 2014 stopped growing their holdings of US Treasury Bonds and sold about $300 billion worth of Treasuries. In their well, their so-called FX reserves, which is basically their piggy bank, they bought about $600 Billion worth of gold.

I think it ultimately evolved to that because gold isn't used for anything. But gold is portable. It's divisible, malleable. It doesn't rust and so and it endures even in this hyper technical age. It is the most private of all currencies. So the great lie of my lifetime is that crypto was going to be private and was going to free us from, you know, surveillance and control. And that is just not proven true. Gold can actually be moved around privately and stored privately when there's not a digital record of gold.

[True, people don’t get that crypto - or stablecoins - can be tracked while pure gold can not.]

What the hell is going on with gold flows around the world? Gold physically moving from one country to another. Why isn't that transparent? This is public money and this is the reserves of different countries. It's owned by the public of those countries, and there's no sort of transparent record of it.

The UK trade statistics - they show you how much gold is leaving London. They don't want to advertise that. The Swiss data are very, very good. They show you the Swiss data. So you can you have an idea. As long as what it is what they classify as non-monetary gold according to IMF shipping classifications, we'll call them however they, you know, industrial classification non-monetary gold gets recorded.

Monetary gold doesn't have to be declared as it moves. And so when you see the monetary gold movements, there is still very much an element of secrecy and non transparency. And yes, some of that is the public's money and it's not being disclosed why it's moving in and how much exactly you it's, it's almost like it's almost like the, the like being in the movie jaws right. There are now big movements of gold between countries right now.

Gold has long been the competitor to the dollar system. The only currency that's better than the dollar is gold. And it's been that way for a long time. The Chinese have been buying lots of gold. China's been buying gold to kill two birds with one stone as number one, it will build up and help internationalize the renminbi over time. And also the Americans and the Europeans, they historically tried to prevent gold from rising too much in order to increase the prestige and the attractiveness of their own currencies. And so we're buying gold for that reason.

Gold is very much a geopolitical matter because if you are China and you're buying lots and lots of gold, as China has done over the last 15 years after the great financial crisis, let's be clear - that can be construed in certain circles in Washington and in Brussels and in London as a tax on those nations’ currencies. And so it is in the interest of nations that might want to diversify from the dollar, from the euro reserves. Trying to manage currency systems from two opposite sides of the coin.

If you google gold - you’ll get bogus numbers held by each country. None of that is true.

The U.S. in the 60s was losing a lot of gold, right? The dollar was pegged to gold at $35 an ounce. Everything else was tied to the dollar. And it started becoming clear as we got deeper and deeper in Vietnam and guns and butter with LBJ, that we didn't have the gold to cover our debt offshore at $35 an ounce, and foreign countries were trying to redeem their dollars in gold, and we didn’t have it.

After World War Two, we had 18,000 tons of gold, official gold. And by the time we got to 1971, we were down to the 8,100 we have today. So we shipped out about 10,000 tons of gold to satisfy these debts. The French sent warships into New York to pick it up. We were sending an airplane a month to Riyadh with bullion, right, to settle gold deficits as we had agreed to it.

Nixon stopped that and said, we’re not sending foreign countries our gold. Nixon ended the gold standard. Nixon said, the dollar's now free floating. You can read from these declassified documents that the U.S. very much had an interest in getting gold out of the system we didn't want, because there were there was one of the declassified documents in question.

There is there was a proposal by the Europeans to revalue their gold to settle oil deficits. Right. Because Europe doesn't have a whole lot of oil. They were importing much oil. Oil gone up a bunch in price. So they had a bunch of oil deficits. They were looking to basically revalue gold and then settle deficits with OPEC in gold.

This is not we want we want the Saudis not getting gold. We want them getting Treasury bonds. And so write the famous Bill Simon deal. You know, we'll give you not only, you know, you take the gold, you take the lead and the gold is we'll provide you protection, we'll provide you weapons will let you access door markets. And if you don't do it, we're going to regime change you. And oh, by the way, we'll give you maybe a sweetener on your you know, I think it's very possible they were getting higher than market interest rates on the Treasury bonds for decades as part of that deal.

It's always about power and control, right? This is about control of the system. This is the dollar system. Clearly 1971, America defaulted on gold to foreign investors [and Nixon had to fix it.] By the way, FDR defaulted on gold to AMERICAN INVESTORS, NOT JUST FOREIGN.

Go back to that policy of petrodollar. We don't want gold back in the system. The Europeans do. We don't. This is the deal.

Gold on some level, is a hedge or an insurance policy against the existing system, as it has been allowed for the last 50 years. If you are opening pushing gold - that means you are betting on the current system to fail.

Right now, gold is flowing from the UK and the EU, to a lesser extent into the US, it's still flowing into China. It flows into China all the time. But they're the big delta.

The big change in since the Trump election essentially has been a significant ramp up in the flows of gold out of the UK into the US.

At some point Bitcoin (or crypto or a stablecoin) could compete with gold in my opinion. But I think that's far down the road.

Let’s say we discover an asteroid that has, you know, gazillions of dollars of gold on it. And we have developed the ability to go up there and bring it back cheaply in a way that competes.

Gold is hovering at about $3000 an ounce. Is there a threshold at which it makes sense to mine it or go get it - because there's a lot of gold actually in the Earth's crust and in the ocean.

You need to expend a lot of energy to get gold, and the price of gold determines how much energy you're willing to expend to get it. It's just a compressed and portable storage of energy.

Trump is going to revalue oil and gold reserves.

The U.S. has a reserve currency, and then there are U.S. creditors that import energy and U.S. creditors and export energy. Right. And they all want a bunch of bonds, and they own a bunch of financial assets.

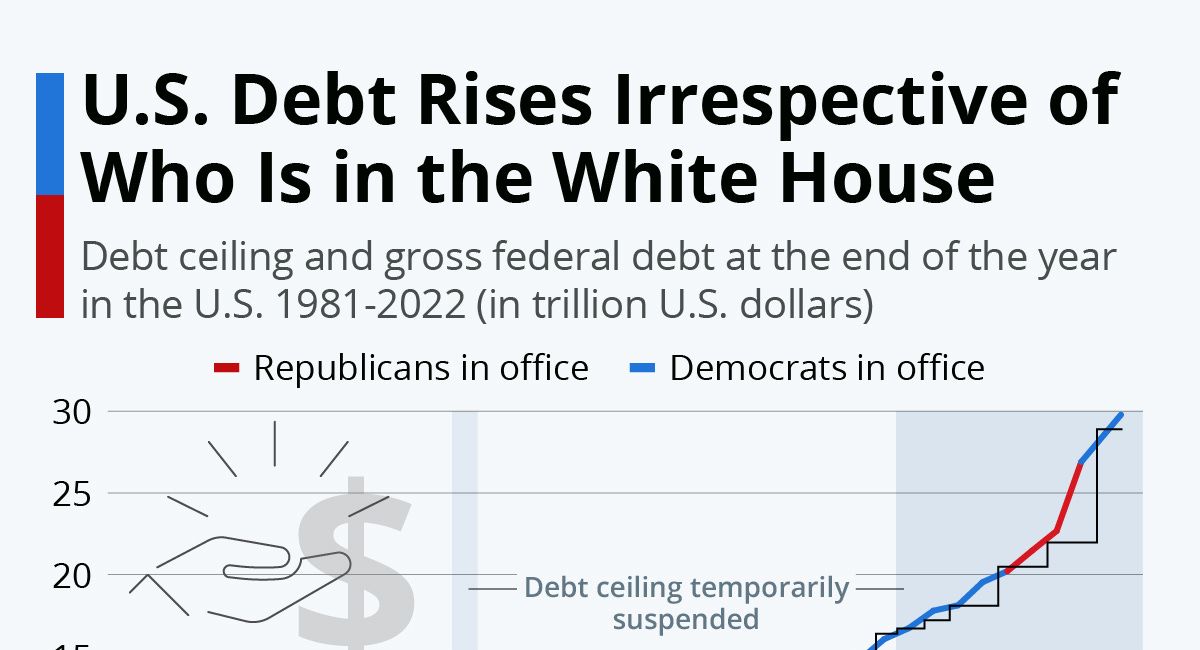

When you have high levels of debt, it's the debt that creates the problem. If you see all these countries buying this gold, you know that if you revalue gold enough to basically re-collateralize, or buy down your debt so that you have low debt levels, then you can make dramatic changes to the economic system without blowing it up.

[Bessent already said he’s going to do this - monetize our assets (gold, land, resources, etc.) so we can use them to restore America.]

I'm not talking about a gold backed currency - but if your debt to GDP is low because you've revalued your gold much higher and restructured your balance sheet. So gold is, paradoxically, a way forward for a major change, be it geopolitically or energy or AI something deflation.

The United States is acquiring gold. Why? The official nominal reason being given in markets and in the media is Trump’s tariffs.

This is what the story is, is that this there's been this massive flow of gold out of the UK to the US because tariffs might happen, which would impact the price of gold in a manner such that it would be very disruptive to what are called basically spreads rates that gold traders in New York or London, bullion banks that that traffic in gold bullion they may have a position on in gold futures in New York and a physical gold position in London. And if a tariff were to change the price relationship between those two, it could create significant losses for them. And so the response is basically bring the gold here to mitigate that risk. That is the official story. There is absolutely a strong element of truth to that.

With that said, the longer this goes on and the gold flows continue, the less that story holds up as the sole reason. When we go back in time to 2020 and during Covid, we saw a very similar spike in gold futures relative to spot prices in London. And it was driving a massive flow of gold out of London here because of Covid, because supply chains broke down with the shutdowns of flights and what have you, a lot of gold is shipped on in her in a transatlantic commercial airliners. And the cargo holds. The more likely it becomes, in my opinion speculatively, that the tariffs are on some level as reason for the gold flows cover, that the gold being brought here for some other reason.

There has been increasing speculation in the aftermath of Trump's election that there is a gimmicky but completely legal and mandated in the rules way by which the United States could revalue its gold, which it currently holds on its books, at $42 per ounce up to the current market price, of $3,000 plus.

And in so doing, it creates a bank deposit, basically at the Treasury's bank account at the fed that the Trump administration could then use to buy down debt to not have to borrow as much. It's effectively money printing through gold. It's creating money supply, using gold through basically an accounting gimmick that is already on the. But that gold would never be sold anyone. It's just literally an exchange of paper.

This is a this is a discussion that goes back to the 70s. There was something called the blessing letter. Carl Blessing was a governor of the Bundesbank, the German booster Bundesbank and the French were asking for their gold back. Others around the world were asking for their gold back in the in the 60s and 70s.

The Germans started hinting about asking about their gold back, and the Americans sent a letter that essentially said, you know, if you ask for your gold back, we will have to reconsider stationing U.S. troops in West Germany to protect you from the USSR. So you're going to keep taking dollars, or else we're going to bring our boys home, and you can deal with the Soviets yourself. And the Germans never asked for the gold back.

I don't think the gold is thought of as collateral, but it could be as a reserve asset.

The gold movement is ultimately what you see if you if you take a step back and try to see the forest for the trees of what the Trump administration is trying to do. The defense industrial base has been too hollowed out by our currency system whereby we export dollars and we export our factories and our workers, and China sends us stuff and we send them dollars and they send us goods, we send them dollars. And then they reinvest those dollars in our financial markets. That has been how the world has worked for 50 years, and it's been great for Wall Street. It's been great for Washington. It's been great for China. It's not been great for the the American middle working class whose factories got off shore to China. And Washington was fine with that until all of a sudden they realized this process has gone so far.

We cannot credibly fight a war without Chinese factories - that’s the problem. We need to get out of the business of supplying China the dollars to buy up the world we need. And that means we need to change the currency system that's been in place for 50 years.

If the U.S. isn't going to run deficits, run up debt to supply the dollars to the world, who will? No one else will. The Chinese won't, and no one else can. And that is correct. And the answer is, is then you're going to have to settle deficits in something else that is nobody else's debt, nobody else's liability. And that is gold. And I think that's where this is going, which is and I think it's part of the reason why the U.S. is actually buying gold is to try to turbocharge this change to the system.

When you hear President Trump say, we want to go back to tariffs and cut income taxes, when you hear Marco Rubio in his confirmation hearing, say, within ten years, we are going to be dependent on China for everything. If we do not take aggressive actions to change and start to restore change.

We are the Saudi Arabia of money. That's how the system has worked for 50 years. We produce the world's reserve currency. And what has followed is the hollowing out of industries other than those most closely tied to the money printer, to the dollar - Washington, Wall Street.

Trump is saying we want gold to be a neutral reserve asset. What we're going to do is move toward a system where we bring factories back. We put tariffs on. We lower income taxes and U.S. consumer spending rises. Foreigners send goods here and also pay us tariffs start to reinvest in our factories instead of just buying our treasury bonds and our financial assets. Employment goes up, building goes up, growth goes up.

Ultimately, though, if they're not recycling their dollars into, you know, they can only put so much in factories. They're not putting them in treasury bonds anymore. They haven't for some time. What are they going to put it in? If they have a surplus left over from dealing with us, where they can put their surplus dollars - I think the answer is gold. The pronouncements from Trump and others make it more likely that these flows of gold into the U.S. are effectively front running what will likely be a higher price of gold, driven there by the recycling of global trade more into gold and less into U.S. financial assets than has been the case over the last 50 years.

It has become clear that the status quo dollar system has become an acute national security threat to the United States on two fronts. We can't make weapons, which we keep hearing. We can't make them fast enough to credibly defend our allies. And project power. And our debt has gotten so high that that too has become a national security threat. And this sort of checks both boxes of, of in terms of this systemic change. And it it makes America great again.

Trump saying that he wants to make us great again like we were 1870 (Andrew Jackson’s veto of the Second Bank of the United States in 1832 left the United States without a central bank until the Federal Reserve was established in 1913) - which is tariffs, low income tax, no income tax. Rubio saying, listen, guys, we can't make stuff in ten years. We're going to be dependent on China for everything we need. Bessent saying in his confirmation hearing Wall Street's had a great run. Main Street has really suffered its main streets time. We need to pursue policies to bolster Main Street. Wall Street will still be okay. They'll still do fine. Maybe not as well, but it's main street’s time. We need a main street. These policymakers are telling us.

And it all, in my opinion, goes back to the structure of the system, which is as long as we store global surpluses in our financial markets and in particular treasuries, that system is going to continue. You move to a neutral reserve asset like gold, because now when they store money in gold, the price of gold goes up.

Okay, that’s basically what Tucker’s guest said on his show. There’s lots of good information in there that we should digest. What does this mean for the average person?

First, this is probably a good time for you to review my 6-part series on Trump’s plan for Saving America - because it all ties together with what Tucker’s guest just said.

Saving America: Part One (A Team of Rivals)

People are wondering why all of a sudden President Trump has reached out to liberals and wealthy tech donors like Elon, RFK Jr., Bill Ackman, Peter Thiel, David Sacks, Larry Ellison, Sam Altman & Marc Andreessen to form a Team of Rivals like Lincoln did.

Over the past 150 years, the price of gold has skyrocketed 4 times and crashed 3 times. Why? Because its purpose as GEOPOLITICAL TOOL CHANGES over time. It has just changed again.

Second, in January of 2023, I wrote about how the big banksters behind the NWO wanted to confiscate our money, put it in a CBDC, give us back 10 cents on the dollar and use it against us. I talked about how 20% of our spending was on waste and fraud. I talked about how Trump wanted to CHANGE ALL THAT and stop their plan for a central bank digital currency to control us. I was correct. That’s exactly what he is doing. Trump wants to STOP THEM and use gold (and crypto) as a leverage to defeat our enemies, pay off our debt and restore America to greatness.

Let's talk about money!

Yesterday somebody responded to me on social media, out of the blue, about the pending Global Financial crisis.

So, now, after you’ve read all that - let’s ask some questions.

Will America be going back to a gold standard or is this just a geopolitical ploy, a balance sheet ploy and debt reduction ploy? Will he be confiscating gold from Americans (like FDR did) and handing over our gold to other countries (I think not.) Will a trackable cryptocurrency tied to gold (stablecoin) be developed to compete with the BRICs plan for the same and be used to pay off debt?

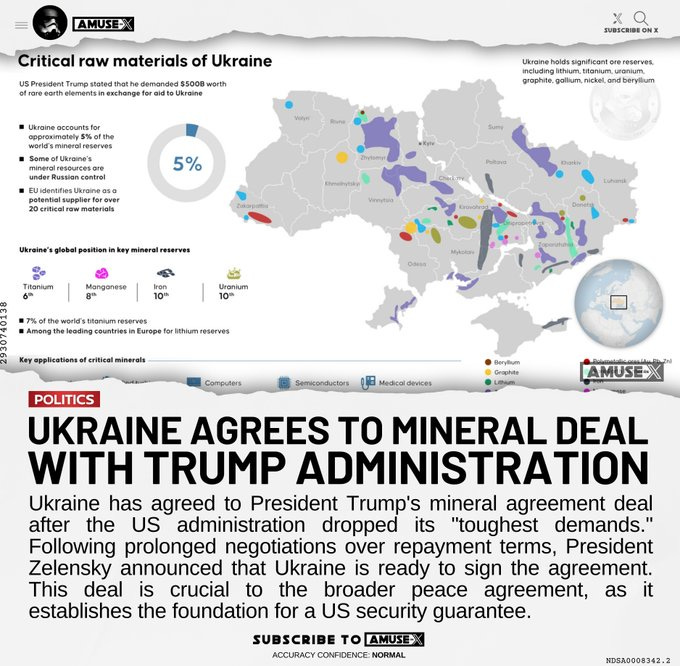

How does gold and crypto (including Bitcoin) play into Trump’s plan for a sovereign wealth fund? Will he allow Americans to invest in the trillions of dollars of untapped mineral resources in America?

Is this one reason that Trump is asking other countries to turn over (trade) their mineral resources to the US in exchange for the money we’ve given them in the past - and the future? Have they found gold on Mars or in asteroids and is that part of the equation? GROK says they have.

These are all good questions that we need to explore and I will do that in the next part of this report. This is a complicated topic and I hope I’m helping explain it. I’m even starting to understand it myself!

My work is free and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

If you like my work, you can fund me by becoming a paid subscriber on Substack or donate by credit card here. My preference is that you donate to me by check - made out to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801. Or, just send me a note or a card - I try to respond to all! I love hearing from you.