As I said earlier, I believe that President Trump’s Plan to Save America involves ENDING THE FEDERAL RESERVE and GIVING BACK control of America’s money to the people. In many ways, he is following in the footsteps of his hero - Andrew Jackson.

There have been various criticisms of central banks, including the Federal Reserve, since their establishment. However, most people don’t really understand how they work or why they are bad. Let’s review how they started in America, why so many people wanted to abolish them - and how it can be done!

The Revolutionary War win of America over Great Britain resulted in a struggling economy and a large debt. Alexander Hamilton, the first secretary of the Treasury under the new Constitution — had ambitious ideas about how to solve some of these problems. One of those was creating a central national bank. Hamilton used the charter of the Bank of England as the basis for his plan.

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker and debt manager, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank.

Not everyone agreed with Hamilton’s plan. Thomas Jefferson and James Madison led a team who opposed the Bank of the United States. They believed that a central Bank was unconstitutional, would infringe on states' rights, and would benefit a small group at the expense of the many.

Thomas Jefferson was afraid that a central national bank would create a financial monopoly that might undermine state banks and adopt policies that favored financiers and merchants instead of home owners, workers and family farmers. Jefferson also argued that the Constitution did not grant the government the authority to establish corporations, including a national bank. Hamilton’s bill cleared both the House and the Senate after much debate. President Washington signed the bill into law in February 1791.

America’s new government created the First Bank of the United States for 20 years to address these issues from the federal level - America’s FIRST central bank - the precursor to today’s Federal Reserve.

The Bank of the United States started with capitalization of $10 million, $2 million of which was owned by the government and the remaining $8 million by private investors. Many of the initial investors were foreign, a fact that did not sit well with many Americans, even though the foreign shareholders could not vote.

The Bank acted as the federal government’s fiscal agent, collecting tax revenues, securing the government’s funds, making loans to the government, transferring government deposits through the bank’s branch network, and paying the government’s bills. The bank also managed the U.S. Treasury’s interest payments to European investors in U.S. government securities.

Unlike modern central banks, the first Bank of the United States did not set monetary policy as we know it today. It did not regulate or act as a lender of last resort for other financial institutions, and it did not hold their reserves.

The Bank of the United States would accumulate the notes of the state banks and hold them in its vault. When it wanted to slow the growth of money and credit, it would present the notes to banks for collection in gold or silver, thereby reducing state banks’ reserves and putting the brakes on their ability to circulate new banknotes. To speed up the growth of money and credit, the Bank would hold on to the state banks’ notes, thereby increasing state banks’ reserves and allowing those banks to issue more banknotes by making loans.

The first Bank’s charter expired in 1811 and the House voted against renewal by just one vote. By 1811, many of those who had opposed the bank in 1790 still opposed it for the same reasons and said the charter should be allowed to expire. By this point, Alexander Hamilton was dead — killed in a duel with Aaron Burr — and Hamilton’s pro-Bank Federalist Party was out of power, while the Jeffersonian Republican Party (later renamed the Democratic-Republican Party) was in control. Also, by 1811, the number of state banks had increased greatly, and those financial institutions feared both competition from a national bank and its power.

The following year, General Andrew Jackson led the U.S. to victory at the Battle of New Orleans, ending the War of 1812 with Great Britain - which many called the “second war of Independence” to stop Britain from RETAKING control of America after the Revolutionary War.

Now that America had defended its existence with military force, it had to develop stronger financial systems to ensure the nation’s long-term success.

The United States Congress authorized a Second Bank of the United States as a public-private enterprise in 1816 for a period of 20 years. The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States and was located in Philadelphia, Pennsylvania. The institution’s capital, reach and responsibilities were more expansive than those of the First Bank. Key duties were to hold the country’s money, generate revenue through loans and pay off the national debt. The Bank profits benefited private stockholders as well as the U.S. government.

The Second Bank held large amounts of other banks' notes in reserve. The bank could discipline banks that it believed were over-issuing notes by threatening to redeem those notes. The Second Bank was larger than the First Bank of the United States and became one of the world's largest corporations. Federalists argued for it, and Anti-Federalists argued against it. President James Madison reluctantly signed the Second Bank bill into law in 1816 after previously opposing the creation of the First Bank of the United States.

President Andrew Jackson, who was elected in 1828, was a central bank foe and vowed to destroy it. Andrew Jackson promised to reform government and high on his list was the “corrupt” and “monstrous” Second Bank of the United States. His position was that Congress did not have the Constitutional authority to create it. Jackson realized that banks held an important role in the U.S. economy but he believed that the Second Bank of the United States held too much power and could wield it at any moment to ruin the U.S. economy. Andrew Jackson is Trump’s hero.

President Andrew Jackson reshaped the American economy to run without a central bank for almost 100 years - until the Federal Reserve was created in 1913.

The “Bank War” was the name given to the campaign Andrew Jackson began in 1832 to decentralize, and eventually dissolve, the Second Bank of the United States.

Jackson thought that central banks put too much power in the hands of too few wealthy American private citizens, and the majority of stockholders were foreign investors with allegiances to other governments.

Andrew Jackson believed that if any government institution became too powerful, it stood as a direct threat to states’ rights and individual liberty.

To hasten the central bank’s end, Jackson ordered that no additional federal funds be deposited into the Second Bank of the United States and the remaining government deposits (20 percent of total funds) be withdrawn and deposited in state banks to perform the various duties of the central bank.

JACKSON: “It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes. In the full enjoyment of the gifts of Heaven and the fruits of superior industry, economy, and virtue, every man is equally entitled to protection by law; but when the laws undertake to add to these natural and just advantages artificial distinctions, to grant titles, gratuities, and exclusive privileges, to make the rich richer and the potent more powerful, the humble members of society–the farmers, mechanics, and laborers–who have neither the time nor the means of securing like favors to themselves, have a right to complain of the injustice of their Government. There are no necessary evils in government. Its evils exist only in its abuses.”

A request to renew the Second Bank’s charter was sent to Congress in January 1832, four years before the charter was set to expire. The legislation passed both the House and Senate, but it failed to garner enough votes to overcome Jackson’s veto.

In 1832, Jackson vetoed the Bank Recharter Bill, declaring the bank "unauthorized by the Constitution" and "dangerous to the liberties of the people.”

Jackson stopped depositing federal funds into the Second Bank and instead placed them in state banks. The loss of the federal government’s deposits caused the central Bank to shrink in both size and influence. In 1833, Jackson used an executive order to divert federal revenue to private banks, ending the bank's regulatory role.

The Second Bank's president called in loans in an attempt to hurt the economy and force the central bank to be rescued. But it failed.

It would be more than 75 years before the United States made another attempt to establish a central bank. During that period, the U.S. economy experienced several banking crises. But, after the Panic of 1907, Congress established a commission to look into ways to “improve” the banking system. The commission’s findings led to the creation of the Federal Reserve System in 1913. Preceding the creation of the Federal Reserve, no U.S. central banking system in America had lasted for more than 25 years.

The Federal Reserve of today is a bankers’ bank. That is, banks hold deposits at the Federal Reserve much like you or I might hold deposits in a checking account at Wells Fargo or Bank of America. That means when the Federal Reserve purchases a government bond from a bank or makes a loan to a bank, it does not pay with cash. Instead, the Federal Reserve just credits the selling or borrowing bank’s account. The Federal Reserve can create money with a mere keystroke. It’s nothing more than a clearinghouse and all they do is basically earn interest on our debt which increases substantially every time we go to war.

The US government borrows money from the Federal Reserve and other creditors to pay its bills when it doesn't have enough revenue to fund its spending and investments. The government borrows money by selling securities like U.S. Treasury bonds and bills, and the national debt is the total amount of money it owes, plus interest to the investors who bought the securities.

President John F. Kennedy felt that the government should control the supply of a national currency and be backed by silver. In 1961, he declared it necessary to “establish a form of permanent government control over the monetary system and the issuance of currency.” He felt that the government should not rely upon the private banking system for its currency, which could lead to instability and economic hardship.

JFK: “I believe that we must establish permanent government control over the monetary system and the issuance of currency.

To do this, the government must have the power to issue its currency backed by the full faith and credit of the United States. Furthermore, this currency must not be a private banking system currency.”

Executive Order 11110 was an executive order issued by President John F. Kennedy (JFK) on June 4, 1963. This order granted the Treasury Department the authority to issue silver certificates, an alternative to the traditional paper currency issued by the Federal Reserve System. He was assassinated 5 months later on November 22, 1963.

This EO caused a stir in the political world, as it was seen as an attempt to bypass the Federal Reserve and create a new, separate monetary system. This executive order was issued to fix the US economy, which was in a state of stagflation due to rising prices and a decrease in the value of the US dollar. Sound familiar? The goal of executive order 1110 was to create a silver-backed currency that would be in competition with the Federal Reserve dollar.

This would be achieved by giving the Treasury Department the authority to issue silver certificates backed by silver bullion, which could then be used to purchase goods and services in the same way as Federal Reserve notes. The idea was that the silver certificates would increase the money supply in circulation, which would help reduce prices and increase economic activity. The silver certificates would also be able to compete with the Federal Reserve dollar since they would be backed by a physical commodity (silver) rather than just paper money.

This would give the silver certificates an intrinsic value, making them more attractive to investors than the Federal Reserve notes. This would also help to strengthen the US economy and lower inflation, as it would create an additional source of liquidity and increase competition in the currency market.

In 2024, JFK’s nephew wants President Trump to finish what Andrew Jackson & JFK tried to do. Use modern day tools to END central bank control of our money and our lives:

“Transactional freedom is an important freedom of expression in the 1st Amendment. Fiat currency was invented to fund war. Fiat currency was invented to fund wars. I like base currencies because they make funding endless wars more difficult, you have to go to the public. You can't just print money to fund wars and tax the public through the hidden tax of inflation. You actually have to go to the public and say, ‘Here's what this war is going to cost.’

US Treasury bills, notes and bonds should be backed with hard assets, including precious metals and Bitcoin.

Backing dollars and U.S. debt obligations with hard assets could help restore strength back to the dollar, rein in inflation and usher in a new era of American financial stability, peace and prosperity. A very, very small, perhaps 1% of issued T-bills, could be backed by hard currencies like gold, silver, platinum or Bitcoin. The benefits include facilitating innovation and spurring investment, ensuring citizen privacy, incentivizing ventures to grow their business and tech jobs in the United States rather than in Singapore, Switzerland, Germany and Portugal.

The Internal Revenue Service treats bitcoin as property and investment rather than currency, which means it is subject to tax on capital gains. It is a mistake for the U.S. government to hobble the industry and drive innovation elsewhere. The Democrats’ proposed 30% tax on cryptocurrency mining is a bad idea.

JFK, when he was in office, understood the importance of hard currency and the dangers of having pure fiat currency with no other option. He understood the relationship between fiat currency and war.

Bitcoin is not a security and should not be regulated as one and we need to put an end to the current policies of the Biden administration that punish banks that are dealing with Bitcoin.

We need sovereignty over our own wallets, transactional freedom and a currency that is transparent. We need to put the entire U.S. budget on blockchain so that any American — every American - can look at every budget item in the entire budget anytime they want 24 hours a day. We need to make sure America remains the hub of blockchain technology.”

Like all revolutions, it will require a cadre of counter-elites dissatisfied with the current New World Order and who want to build a new one. It will require grassroots support and understanding of purpose. The only real avenue for that to happen today is with President Donald Trump and the team that has gravitated towards his campaign.

In the next chapter - I’ll examine America’s debt and exactly WHO OWNS IT - which no one ever talks about - and how I think President Trump’s Team of Rivals plans to pay it off and return control of America’s money to the people - using AI, Bitcoin, precious metals and OTHER monetary tools.

God Bless America!

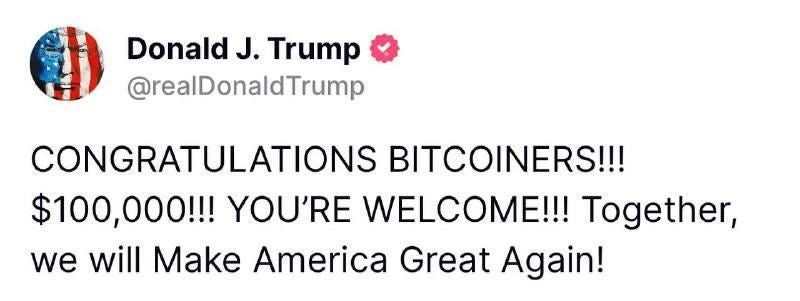

3 months later:

You can find all the chapters here:

If you like my work, you can fund me by becoming a paid subscriber on Substack, donate by credit card here or you can send a check to Peggy Tierney, PO Box 242, Spooner, Wisconsin 54801. Or just send me a note or a card! I love hearing from you.

I’ve written over 2,000 newsletters after being relentlessly censored and banned on social media. My work is FREE and supported by your generous donations. Thank you to all who have donated in the past. I truly appreciate your generosity!

You can find all my newsletters at my website at TierneyRealNewsNetwork.substack.com. You can search archives of my posts by keyword at https://tierneyrealnewsnetwork.substack.com/archive. You can send me an email at tierneyrealnewsnetwork@substack.com.

Please follow me on Telegram at t.me/TierneyRealNews. Follow me on Facebook at https://www.facebook.com/profile.php?id=100079025148615 (although they block me quite often there.) Or you can find me on Truth Social at @MaggiePeggy123. Or on Twitter (X) @MaggiePeggy1234.

Thanks again, and please share my newsletter and encourage your friends to subscribe! It’s free and always will be!